Commentary for Friday, May 22, 2015 – Gold closed down $0.10 on the Comex today at $1204.30 as Fed Chair Yellen looks for an interest rate rise before year end – if the economy continues to improve.

Gold popped higher in overnight activity (Hong Kong) but domestic trading on the Comex reversed this strength.

The euro of late has reversed direction moving off a low around 1.10 to an overnight high around 1.12 probably a result of Draghi’s front-load QE strategy launched earlier this week. The ECB quantitative easing program should have supplied 60 billion euros monthly in fresh asset purchase cash but got off to a bang when that number was increased to 100 billion euros.

This should have pushed the dollar lower – which was the case in overnight trading but early domestic trading presented a different scenario. According to CNBC – The Labor Department said on Friday its Consumer Price Index rose 0.1 percent last month, with the core figure discounting food and energy costs up 0.3 percent, for the largest gain since January 2013.

I don’t read this as an inflation scare but that core number of .3 percent was a surprise and it stopped the overnight move to higher ground in its tracts. The theory being that if the Federal Reserve moves above its 2% inflation guideline it will be forced to raise interest rates this summer.

The Dollar Index which looked like it was topping out earlier this week around 95.00 or less soared on this reversal of sentiment regarding what the FOMC will do with interest rates. Earlier this week they were dovish – now they might turn hawkish. The Dollar Index as of this writing is trading hot – at 96.23. And this obviously reversed any overnight gain and pushed domestic prices back to almost unchanged.

Fed Chair Yellen spoke at a luncheon in Providence, Rhode Island today. And she was typically positive about the improving economy. She claimed that if these numbers continue to improve we will see a rate hike this year – but it will take several years before we are back to what some consider “normal” rates of interest. She also claimed that recent off-beat economic numbers are transitory – also a familiar position the Fed has adopted to deal with any number which does not support an improving case.

Trying to figure out what the Federal Reserve has on its mind is impossible. This past Wednesday the FOMC release convinced most that a rate hike this year was off the table. Now it appears it is back and a certainty if the economic improvement numbers do no flatten out. If anything can be gleaned from this latest Fed information it’s that a rate hike may not materialize by summer but will be seen perhaps by year end.

Over the past 30 days gold has traded back and forth between $1180.00 and $1220.00 – testing the lower range on three different occasions. The bear trade has not been able to create a significant break to the downside but at the same time gold sees heavy overhead resistance at $1230.00.

Trading on the exchanges for the rest of the day should remain quiet going into the long weekend. Markets both here and in Europe will be closed on Monday for Memorial Day.

Silver closed down $0.05 at $17.06.

Platinum closed down $3.00 at $1148.00 and palladium was higher by $8.00 at $784.

GoldDealer.com will be closed this Monday – Memorial Day as we salute our men and women of the armed forces and remember their sacrifice. We are proud to say our staff includes members who have served in the Army, Marines, Air Force and Navy – two of which saw action in Vietnam.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 7 believe gold will be higher next week – 4 think gold will be lower and 2 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 38 people thought the price of gold would increase next week – 43 believe the price of gold will decrease next week and 19 think prices will remain the same.

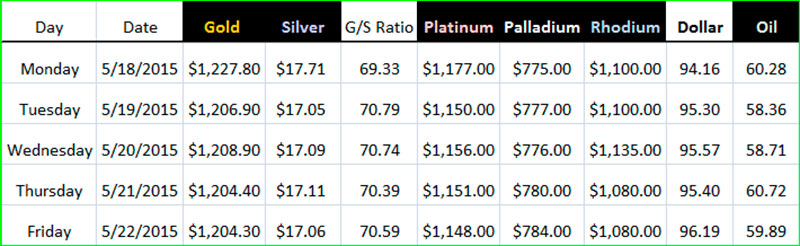

Precious Metal Closes & Dollar Strength – May 18 – May 22

This from Kitco – Gold To Bottom In 3Q, Fed Rate Hike To Be Pivot – Macquarie – The minutes of the Federal Open Market Committee meeting indicated that it is “unlikely” interest rates will rise in June but that still leaves a September hike on the table and that will weigh on gold, according to one firm.

Commodity analysts from Macquarie said, in their latest research report published Wednesday, they are expecting gold to continue to suffer as markets wait for an eventual rate hike.

“But the waiting will be worse than the reality and we think lower-for-longer global interest rates and still-robust emerging-market demand should allow the gold price to make steady gains in 2H 2015 and 2016,” they said.

Although the Australian-based bank is optimistic on gold prices in the medium and long term, they warned that prices could fall in the near-term. Because of delayed rate hikes, the bank is now expecting gold to bottom out in the third quarter.

“The pivot, for us, remains when the market has finally priced-in a Fed rate hike,” they said.

“We now believe September is the most likely data for this, though that is at the latest and we would expect the data to have improved sufficiently in 2Q to finally make investors accept it is going to happen. As we write this it has not happened so far, indeed some data has been very poor and given gold another run higher. But such sentiment is fickle and could change almost overnight, certainly we expect more robust U.S. data in the next few months,” they added.

Macquarie also said they remain optimistic on the gold market as investors embrace the idea that equilibrium in interest rates will be lower than historical norms.

The analysts note that a strong positive for the gold market has been relatively stability as prices have hovered around $1,200 an ounce, despite high volatility in currency markets. Although it lost ground against the U.S. dollar, it gained against other currencies like the euro. At the same time, when the U.S. dollar lost steam mid-April, gold rallied but lost against other currencies.

“The conclusion is perhaps exchange rates don’t matter quite as much as we thought they did though short-term we think they still exert an important influence,” they said.”

Turning to investment demand, Macquarie said they don’t expect to see major redemptions in gold-backed exchange-traded funds (ETF) any more “…with most of the large-scale institutional fund money no longer in gold.” However, ETF gold reserves could be volatile as they will now be driven by short-term price moves.

This from Ole Hansen (Head of Commodity Strategy / Saxo Bank, Denmark) – Gold stuck in a band 2.5% to either side of $1200 – Bullish bets in Comex gold down at 2013 levels – The yellow metal is in need of a clear driver – “Gold has traded within a relatively tight range for the past two months. During this time the average price has been just below $1200 with the price staying within a 2.5% range either side of that.

The current lack of direction has resulted in volatility and investment holdings in exchange-traded products both coming lower while bullish bets in Comex gold held by money managers have fallen to levels last seen when the price collapsed back in 2013.

The current range-bound nature of the market is also a clear indication of how the yellow metal currently need a clear driver and it has left the market very split on where we go from here. Gold has been in a rut and the market is divided on where it goes from here:

Spot Gold – Increased volatility in secure European government bonds and speculation that the US Federal Reserve is in no hurry to raise interest rates anytime soon, combined with a weaker dollar, were the key drivers behind the recent run to the top of the current range. The subsequent recovery of the dollar, verbal intervention from the European Central Bank with regard to its current bond buying program and stronger than expected US data have once again sent the metal back to the starting point. On the surface the options market reflects this lack of direction with the implied volatility easing towards an eight month low.

Gold volatility – While the sell-off during the past week has resulted in a downshift in volatility as we are once again back to the center of the current range, the volatility skew or smile has remained intact. This is both an expression of the current uncertainty regarding where we go next but also an indication that traders prefer to express a view through options.

Gold volatility skew – The top ten most traded options strikes during the past week are almost evenly split between Puts and Calls. The most popular has been the 1200 Put which expires next Tuesday, last traded at $3.5/oz.

Investment demand through exchange-traded products has slowed further this month as investors used the uptick during the early part of May to reduce exposure. With total holdings once again close to a six-year low it can be argued that most of the reduction has taken place by now given the resilience among existing investors the last time this level of participation was seen back in January.

Gold ETP holdings – Money managers who are often the trendsetters have also found little to cheer about and they are currently holding a net-long futures position close to the lowest since 2013 – the year of the big sell-off. A relatively large short position, last at 75,000 lots is not far from the 80,000 level. On several occasions since 2013 we have seen the number of short positions contract sharply every time this level was reached.

Speculative positioning in COMEX Gold futures – On balance, gold is desperately looking for a driver or an event to give it a new lease of life. Several attempts in either direction have failed over the last couple of months as uncertainty with regards to the timing of the first rate hike in the US, the movements of the dollar and gyrations in bond markets have all left gold going nowhere.

The speculative position is very light, especially to the upside, which leaves money managers with plenty of room to engage should we see a change in sentiment. So far, however, many are happy to sit on the fence and wait for the break and in the meantime play such a potential break through the options market.”

The walk-in cash trade today was quiet and so were the phones.

The GoldDealer.com Unscientific Activity Scale is a “ 3” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 5) (Tuesday – 5) (Wednesday – 3) (Thursday – 2). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy a long weekend. We will be back to work this coming Tuesday after Memorial Day.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.