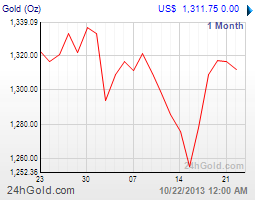

Commentary for Tuesday Oct 22, 2013 (www.golddealer.com) – Gold closed up $26.80 today at $1342.50 as the dollar moved below 80 on the Dollar Index. Actually the 3-month Dollar Index is a disaster but crude oil is now below $100.00/barrel. So there is a push-pull going on here but a weaker dollar always trumps so gold is helped considerably.

Also keep in mind that the jobs number was delayed because of our friends in Washington but I think real employment numbers meaning how many jobs were lost in this recession versus how many are coming back would scare everyone. By the time you factor in those no longer looking, the type of jobs coming back (low wages), and the plunge in middle-class working Americans you will be scratching your head about the government’s quantitative easing success.

The problem with politicians (both Democrats and Republicans) is that they have the media’s ear and a captive public. Who else are you going to listen to when it comes to questions like is Obamacare going to work or are jobs really coming back to long term unemployed? The truth might expose a system in disarray and if you complain too much maybe the NSA (National Security Agency) gets involved.

How is this for a great political cartoon: an NSA operative is sitting in a sleazy bar when a rather floozy looking women takes a seat next to him and asks if he would like her number? The agent looks up from his drink and says “already have it”.

I would not get too excited over this pop in gold as current overhead resistance posses big problems and until we see another solid run at $1400.00 gold remains range bound with little motivational buzz. Still the weaker dollar is inflationary (better US export business) and smaller real debt value.

Silver followed gold up $0.52 at $22.75 which is the highest close since September 19 ($23.34) so we are heading in the right direction.

The buzz in the silver bullion market recently has been that India is buying silver as a kind of replacement for the gold suppression program sponsored by her government. Keep that in mind as a setup for the following: we sell silver bullion to all 50 states and our prices are cheap so they are representative of what any real bullion dealer is doing these days in a silver market which can be described as weak.

If you look at silver over the past year you will see a market which began selling off above $30.00 an ounce and moved to present support above $20.00 an ounce so we are off about 1/3. So I asked the CNI computer for the actual buying and selling numbers regarding one of the most popular silver bullion products (US Silver Eagles).

What would you guess the sell-back ratio is using relative volume over the past 12 months? We have repurchased about 25% of all the US Silver Eagles we have sold this past year. Obviously that means that 75% of what we sell in this silver bullion product remains in strong hands. So in a generally falling market the real believers in silver bullion are not strong sellers and I would wager this number is consistent with other large bullion houses.

Platinum was up $11.00 at $1449.00 and palladium was higher by $2.00 at $752.00 both producing another large yawn.

This excerpt from Ed Steer’s Gold & Silver Daily was written by Martin Walker (UPI) and points to a problem area which has been pushed onto the back burner: “Europe’s banks and financial officials are all awaiting, in a mix of hope and trepidation, to learn just how the European Central Bank proposes to assess the solvency of Europe’s banks. The procedure goes by the name of the Asset Quality Review, which will judge whether the assets and capital of Europe’s 130 leading banks are worth what the banks say they are or whether they are a great deal more vulnerable than the banks want to admit. The background is important. Europe’s banks have performed pitifully since the financial crisis began in 2007, in part because they didn’t undergo the cuts and reforms of their U.S. counterparts. The difference was that the U.S. banks were subjected to a strenuous and transparent stress test that wrenched a lot of skeletons from many cupboards. The Europeans, by contrast, were put through much gentler and less open stress tests that barely deserved the name, largely because of political interference by various national governments. European banks that “passed’ the test have since gone under.”

I would make the case that even US banks were given a semi-pass considering the collateral damage already done but this article points to Europe. Now consider not only the “not fixed” banking problem and how this relates to the European Union and the euro and you will get back on track as far as gold bullion insurance in that part of the world. Also worth noting is that the financial world loves a good story as well as a disaster and the surging US stock market is getting all the attention. Even the “better” European banking systems (England for example) are up to their waist in debt and following the US lead with quantitative easing. So the question is this: how long will it take for excessive currency debasement to result in another “bubble” no one saw coming?

I thought this was interesting from Bloomberg: Inflation in Asia will drive demand for gold: HSBC – A great many commentators (myself included) have noted that gold demand from both China and India will be responsible for higher prices as the working class in both countries mature into larger consumers. Of course this is a plus for gold but the lack of inflation in the US has been sited many times as a large negative in the complex world of consumer demand.

Most read “inflation” from the US perspective but what about world inflation (a quote from the Bloomberg article): “In markets like India, Vietnam and China, consumers have few tools with which to protect their savings against rising prices,” said Neumann. “In recent years, rising inflation stoked demand for gold in a number of markets.” Consumer prices in China will rise 2.7 per cent next year and 3.1 per cent in 2015, from 2.6 percent this year, according to HSBC forecasts. Inflation in India, seen at 8.7 per cent this year, will be 7.7 per cent in 2014 and 7.9 per cent in 2015. India increased import taxes on bullion three times this year to cool demand after buying helped widen the current-account deficit and hurt the rupee. The government plans to keep imports to 800 tonnes in the year to March 31 from 845 tonnes a year earlier, Economic Affairs Secretary Arvind Mayaram said on October 1.”Soaring gold demand in the region is associated with deteriorating current-account positions,” Neumann said. “Of course, gold is not the only, or even the main, reason for shrinking surpluses (rising oil demand is the main culprit). Still, burgeoning gold imports clearly don’t help.”

US readers interested in gold might overlook the importance of gold bullion as a currency hedge in other countries. In the United States this concept is uninteresting because the dollar is relatively stable but as the Bloomberg article points out there are many large countries with a currency problem: in these countries currency is inflationary or unstable or is unsuitable to retain wealth and is converted to gold as a matter of survival. I think this perspective is an important part of the story behind owning real gold bullion. But in the United States it is overlooked because the price of gold is defined in dollars: moving to the other side of the fence might provide additional perspective.

Our new CNI Activity Scale will take into consideration volume, open and closed orders (buying and selling), the cash trade, and the hedge book: (Thursday – 4) (Friday – 5) (Monday – 3) (Tuesday – 3). The scale is 1 through 10 (5 being relatively busy and this approach considers today’s business so it will be more intuitive). We believe this is a reliable way to give you an idea of what a real bullion business is doing without the sales pitch.

Phase One of our new golddealer.com web site will soon be complete (Oct 28th best guess) and includes a new look along with live pricing. It will also include Live Chat, you will be able to set up your own customer account, and you will receive automatic email confirmation on buying or selling. Look for further improvements before year end which makes accounting, shipping and tracking easier (check to see if we have your email in the new system).

We now offer the choice of USPS or FedEx Ground. Our new flat screens within the CNI Building are up and operational and the cash trade loves this idea. The feed and graphs are live and bullion products are programmed with premium spreads so your choices are easier. There is nothing like this on the West Coast and visitors enjoy complete transparency when buying or selling. Like us on Facebook and follow us on Twitter @CNI_golddealer.

Our Daily Gold Newsletter archive has been moved and enlarged (30 days) to our Facebook page and the new website will include a direct daily newsletter. Remember our best price guarantee (call Kenny 1-800-225-7531 and save money). Thanks for reading and enjoy your evening. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.golddealer.com).