Commentary for Friday, June 5, 2015 – Gold closed down $7.10 at $1167.80 today on the COMEX which makes a loss on the week of $22.00 and in fact today’s market moved as low as $1162.00 before gaining some traction.

Not encouraging to be sure but also not too bad considering dollar strength and the market’s focus on the upcoming Fed interest rate hike.

Today’s close of $1167.80 is also important relative to gold’s moving averages – 50 DMA ($1197.00) – 100 DMA ($1208.00) – 200 DMA ($1210.00). As you can see we are considerably under all three at this point so gold’s technical position belongs solidly in the bearish camp.

All of this will be blamed on today’s news that 280,000 jobs were created in May. And this is true for sure but the stage had been set long before today as the Federal Reserve pondered higher interest rates. Today’s jobs number simply confirmed the interest rate hike everyone was talking about. And yesterday’s IMF comment that the US should leave interest rates alone has nothing to do with us and everything to do with their own pot of troubles.

This is now the third day that gold has moved lower. The loss however is not as significant as one might expect. The Dollar Index was significantly higher because the economy created 280,000 jobs in May – a much higher number than expected. The Dollar Index closed yesterday at 95.43 and as of this writing is 96.42 almost a full point higher – wow! This of course is because everyone is now on board the “raise interest rates” train.

You will remember that this was not always the case. Since the beginning of the year opinions have varied widely from “no interest rate hike in 2015” to “it’s going to happen this summer”. That’s a pretty wide gap but with this latest hop in created jobs I am going to change my original guess from “before year end” to within the next several months.

The Federal Reserve won’t raise the bar much – perhaps a quarter point but they are running out of reasons not to raise rates. And it’s common knowledge that they fear acting too slowly because once the inflation genie is out of the bottle it is difficult to control with monetary policy.

Also note the price of crude oil – weaker. Actually there is still a glut on the market and Saudis and Iranians continue to supply anyone with cash – claiming it’s not them but the speculators who are creating volatility. This week crude oil has moved from $61.00 to $58.00 and I suspect today’s jobs number and higher dollar also helped pressure oil lower.

At any rate the two forces working together – a stronger dollar and weaker oil is the reason I actually thought today’s loss was not that bad. It’s even possible that the Federal Reserve might raise rates twice before year end – I know this might sound like heresy but keep in mind we have been at near zero interest rates for a long, long time. At any rate its obvious gold will struggle in this environment but it’s my opinion this consolidation is at or near a bottom.

On the short term we may retest the $1140.00 range but this support is long standing. The short paper players have tested $1150.00 twice this past 12 months and in each case we have seen physical demand pick up the slack.

If you are looking for something more optimistic consider that there is now a whiff of inflation in Europe. Japan and now the European Union are printing more money, the central banks of the world continue to build their gold war chest just in case this Keynesian nightmare blows up and our friends in China and India keep smiling and buying as prices move lower.

So a couple of final thoughts – the first being that considering how big this job creation number was I would have expected a bigger drop in the price of gold – this should tell you something. The second is that stocks could be in for a tumble. I am not a stock guy but commentators claim a pullback is on the way – and if that occurs it will be positive for gold.

This from Arkadiusz Sieron Gold News Monitor: Shiller and Goldman Say U.S. Stocks Are Overvalued – “Goldman Sachs’ chief equity strategist, David Kostin, said that “by almost any measure, US equity valuations look expensive”, which echoed Robert Shiller’s earlier opinion. Is the U.S. stock bubble finally going to burst? How will it affect the gold market?

More and more analysts are warning against a U.S. stock market bubble. Last weekend, Yale professor and Nobel Prize winner Robert Shiller said that in his opinion U.S. stocks were overvalued. Although he is not sure that the current situation is a classic bubble, he clearly sees the bubble element. For example, Shiller pointed out that the CAPE (cyclically adjusted P/E) ratio has been recently around 27, which is high by U.S. historical standards (the only other times it was that high or higher were in 1929, 2000, and 2007 – all moments before market crashes). What is more, his valuation confidence has recently reached its lowest point since the stock market peak in 2000, implying that people do not believe that current stock valuations are about right. The Nobel laureate also noticed that, unlike 1929, this time all asset classes (and not only stocks) seem to be overvalued.

Shiller’s opinion was shared a few days later by Goldman Sachs’s chief equity strategist David Kostin in his latest weekly note to clients. He pointed out that financial metrics such as EV/EBITDA, EV/Sales, and P/B suggest that U.S. stocks have stretched valuations. He also noticed that the typical stock in the S&P 500 trades at 18.1x forward earnings, ranking at the 98th percentile of historical valuation since 1976. According to Kostin, with tightening on the horizon, the P/E expansion phase of the current bull market is behind us.

What does it all mean for the gold market? Well, the inevitable correction in the U.S. stock market should be positive for the gold price, since a surging stock market hurts demand for the yellow metal. Indeed, investors cut holdings in bullion-backed exchange-traded products to the lowest since 2009 as they are looking more at the stock markets rather than buying into the precious metals. Having said that, it is even more surprising that gold has held around $1200 for two years now. Of course, nobody knows for sure when the stock market boom will end. However, it seems that the irrational exuberance will last some time thanks to corporate buybacks. Indeed, the share repurchases seem to be the biggest driver of rises in the U.S. stock market. Goldman’s analyst forecasts that buybacks will surge by 18% in 2015 exceeding $600 billion.

To sum up, more and more analysts are warning against a U.S. stock market bubble, including Nobel Prize winners and Goldman Sachs. It may be a landmark, since what Goldman says often becomes policy. Yellen some time ago admitted that stock market prices were quite high. When the Fed hikes rates – to save its credibility – the stock market boom will end. This could be positive for the gold market, as investors could then fly away from U.S. stocks and the demand for precious metals would increase.”

Silver closed down $0.12 at $15.97 and we are down $0.72 on the week. We are now in the sweet spot for silver investors looking for value – our CNT depository program is hot and I think anything less than $16.00 for silver continues to create physical action.

Platinum closed down $8.00 at $1092.00 and palladium was off $5.00 at $750.00. Platinum was down $19.00 on the week after a $37.00 decline last week and is now trading $75.00 less than gold which should invite some trades of gold bullion for platinum bullion.

This from FXEmpire – “The world economy is set to grow less this year than last year, according to the latest forecast from the Organization for Economic Cooperation and Development. In March, the OECD was projecting 4% global economic growth for 2015. On Wednesday, it slashed that to 3.1% – which would be less than the 3.3% growth the world saw last year. Two of the largest engines of the world economy – United States and China – have slowed down.

China simply wasn’t able to sustain its incredible growth, and that has had ripple effects around the world. Manufacturing and exports have cooled, and the real estate market isn’t the slam dunk that it once was. In the U.S., the strong dollar has been a drag on growth. American companies are losing money overseas and foreigners aren’t buying as many U.S. goods since they appear more expensive.”

If these predictions prove correct platinum could move lower in price. And it might explain why we have not seen a big increase in platinum sales even though the price of platinum is now around $80.00 less than the price of gold. Still there is not a great deal of platinum bullion around especially the popular American Platinum Eagle 1 oz. The premium on this coin remains strong even though there is talk that the US Mint might soon begin production. If you are careful you can also pick up proof examples of the Platinum Eagle at little extra cost. Since 1997 the reverse of all proofs have been a different design. They make an impressive collection which might at some point pay additional dividends.

This from CNBC – US Treasury yields surge on jobs data – U.S. Treasurys plunged on Friday, sending yields soaring, after the monthly jobs report came in much stronger than expected.

The U.S. economy created 280,000 jobs in May, better than expected and likely confirming hopes that growth is back on track after a slow start to the year.

Nonfarm payrolls were seen rising by 225,000 positions in May after increasing by an initially reported 223,000 a month earlier, according to a Reuters survey of economists. The unemployment rate was expected to hold steady near a seven-year low of 5.4 percent.

The yield on the 10-year Treasury soared to as high as 2.442 percent following the release, about seven basis points higher from where it was ahead of the release. It most recently traded at 2.3896 percent.

Yields on 30-year Treasurys rose to 3.1366 percent from about 3.06 percent. It last held at 3.0778 percent. The yields on 2-year Treasury notes also spiked from 0.67 percent to 0.745 percent. It was last up at 0.7326 percent.

“Bottom line, the very good job gain in May puts the 6 month average at 236k vs the 260k average in 2014 as the May gain made up from only modest job gains in January, March and April,” Peter Boockvar, chief market analyst at The Lindsey Group, said in a note.

Treasury yields have tracked German Bund yields sharply higher this week amid a view that bond-buying by the European Central Bank may have helped avert the risk of deflation. The ECB this week raised its inflation forecasts while data on Tuesday showed inflation in the euro zone rose by more than expected in May.

“Combining a still good growth rate of over 200k per month with the uptick in average hourly earnings is making the Fed’s zero rate policy looking more and more inappropriate to say the least and the US Treasury market is not waiting around for the Fed to act,” he added.

Investors also kept an eye on oil as OPEC has decided to maintain its production levels for at least another six months. The cartel maintained its collective output production level at 30 million barrels per day, which could continue to weigh on oil prices this year, as oversupply has dominated markets following the group’s decision not to cut production at its last meeting in November.

Elsewhere, U.S. stock futures were a touch firmer while European shares were broadly weaker amid uncertainty over Greece and caution ahead of the payrolls report.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 5 believe gold will be higher next week – 5 think gold will be lower and 2 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 35 people thought the price of gold would increase next week – 55 believe the price of gold will decrease next week and 10 think prices will remain the same.

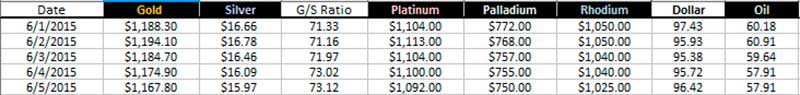

Precious Metal Closes & Dollar Strength – June 1 – June 5

The walk-in cash trade today was active most of the day and the phones were average going into the weekend. Silver seems to be getting all the action but the ethnic gold cash trade across the counter is as dependable as the sun when prices move lower.

The GoldDealer.com Unscientific Activity Scale is a “ 5” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 5) (Wednesday – 7) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”. Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

Thanks for letting us know when you move or change your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your weekend.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.