Commentary for Friday, May 1, 2015 ( www.golddealer.com) – Gold closed down $7.90 today on the Comex at $1174.50. This morning’s gold market remains weak and off-balance as technical selling is the order of the day. This further weakness from the big Thursday’s route was anticipated as the Federal Open Market Committee comments this past Wednesday were hawkish and some believe we will see a small interest rate hike this summer.

So today’s weakness looks like momentum selling to me and another attempt to break down a rather long trading range by the short paper players.

The 30 day trading chart in gold is definitely range bound between around $1180.00 and $1210.00. And the one year chart on gold shows a double bottom in the $1140.00 to $1150.00 range so the downside from today’s pricing is small and the long term chart would suggest gold is now entering an over-sold position.

A higher Dollar Index this morning also supports this latest weakness in gold as the index at 95.11 is trading above yesterday’s close but open the picture somewhat to a look at the 5 day Dollar Index and you will see the trend has been generally lower which over time will support the price of gold in this most current trading region.

We often talk about gold relative to dollar strength and use the Dollar Index as a way of tracking dollar strength. The US Dollar Index is actually an index or measure of value for the dollar relative to 6 other currencies, each of which is weighted according to importance.

The Euro (57%) the Japanese yen (13%) the Pound sterling (11%) the Canadian dollar (9%) the Swedish krona (4%) and the Swiss franc (3%) and the Dollar Index has traded as low as 70.00 and as high as 154.00.

The common feeling today is that the index now around 95.00 could get stronger especially on the shorter term because in times of instability traders seek refuge in the dollar. In the past three years the Dollar Index has been rather stable around 80 but in 2014 it began rising and within a year moved to around 100.00.

And because the US economy relative to Europe is getting traction many believe the Dollar Index will continue strong – this would not be good for gold. A stronger Dollar Index will cap any upside gold has for the time being.

But if you take a step back and look at the Dollar Index chart over the past year you will see something interesting. The move from 80.00 to 100.00 is in trouble technically and may be losing steam. I am not saying the dollar run is over but the Dollar Index has recently attempted to move above 100.00 several times and failed.

If this trend continues and traders decide this run is over you could see a more back to the more historical acceptable levels – perhaps even back to 80.00. This would give gold more than a rest – it would further support the bottoming out process and could be the second most important factor in price recovery (the first being actual physical demand).

So while the press on gold is not encouraging these days – when it comes to gold and safe haven buying things have a habit of changing quickly.

Finally when the dollar does begin to act like inflated currency and this charade of dollar invincibility crumbles everyone will claim they saw it coming.

The idea that markets are closed in mainland Europe, China and Singapore would also suggest you might be seeing a bear raid by short paper traders looking to take advantage of weakness earlier in the week. Monday and Tuesday of next week should give us a better picture and I suspect we will continue to be range bound in gold.

Silver closed down $0.01 at $16.11.

Platinum closed down $10.00 at $1130.00 and palladium closed down $2.00 at $774.00.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 6 believe gold will be higher next week – 3 think gold will be lower and 1 believes it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 46 people thought the price of gold would increase next week – 45 believe the price of gold will decrease next week and 9 think prices will remain the same.

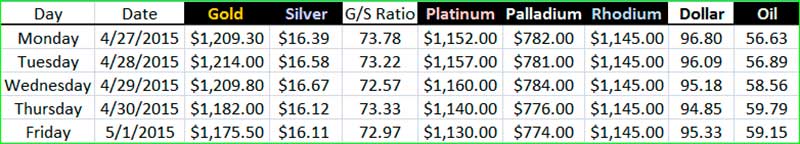

Precious Metal Closes & Dollar Strength – April 27 – May 01

The walk-in cash trade was active today – the downstairs was crowded for more than half the day. The national phones were also active but more like an average day. Most of this action was small to mid-range buying and very little selling. Some trades of gold bullion for platinum and continued interest in US Silver Eagle Monster Boxes.

Here is an observation – our buy-back rate for Monster Boxes is virtually zero relative to what we sell. In other words almost no one brings back any boxes to raise cash. This is true whether the markets are moving higher or lower so my question is this: where are all these Silver Eagles going? Feel free to opine and email your feelings to RSchwary@aol.com.

The GoldDealer.com Unscientific Activity Scale is a “ 3” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 3) (Tuesday – 5) (Wednesday – 4) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.