Commentary for Wednesday, Feb 18, 2015 ( www.golddealer.com) – Gold closed down $8.40 on the Comex today at $1199.70 and actually traded as low as $1197.00. There is a good long term case that gold will hold on either side of the $1200.00 Maginot line but I have to admit the water is getting hot – and keep in mind the low on the year so far was Jan 2 nd ($1186.00).

After the close the release of the FOMC Jan 28 th and 29 th minutes indicated the Federal Reserve was not in any hurry to raise interest rates. The aftermarket jumped by $10.00 so you can see how sensitive gold is to the upcoming Fed rate hike. The Federal Reserve is holding everyone’s hand because recent economic data looks weak enough to cause concern even though the coming rate hike might be based simply on better job numbers.

There is plenty of commentary which point to an improving situation in Greece. This has taken considerable pressure off the worst European scenario. I guess the big question is still whether she will exit the European Union and default on the credit card bills to this point. Who knows – this question is On Again Off Again Sam (debt extension and increase) – my best shot is that if anyone was really worried gold would not be struggling around $1200.00.

And the Chinese market being closed for the Chinese New Year does not encourage gold traders – their markets will be closed for 5 days beginning today.

News this morning shows that India is doing well – her stock market is up 40% this year and some are now saying that India might replace China as the world’s biggest manufacturing hub. I don’t know about that but good news for India is good news for gold regardless of what she finally decides to do with importation. And the big surge in that economy is attributed to lower oil so things could be looking better for all of 2015.

Silver closed down $0.11 at $16.25 today and unfortunately I can’t say the phones are ringing off the hook. Still silver is cheap with $1000 face 90% silver bag premium at $1.50 over spot delivered! The same is true of 100 ounce JM silver bars at $0.68 per ounce over spot delivered. A bright spot – one of our biggest silver bullion buyers stopped by today which is always encouraging. If I am down in the dumps over prices all I have to do is talk with this fellow for a few minutes and I’m pumped up again. It’s amazing – the power of conviction.

Platinum closed down $10.00 at $1170.00 and palladium closed down $7.00 at $776.00.

NEW YORK ( MarketWatch) — U.S. stocks retreated on Wednesday, as weaker-than-expected economic data and uncertainty about Greece’s debt negotiations weighed on sentiment.

Investors are eager to get a peek this afternoon at minutes from the Federal Reserve’s January meeting. The S&P 500 SPX, -0.30% retreated from record levels reached on Tuesday. Energy stocks fell as oil prices dropped ahead of a report on stockpiles in the U.S.

The Dow Jones Industrial Average DJIA, -0.26% traded lower, but stayed above 18,000. The blue-chip index on Tuesday closed within 6 points of its record set Dec. 26. The Nasdaq Composite COMP, -0.10% was flat at 4,896.6.

Chris Gaffney, senior market strategist at EverBank Wealth Management, said the fact that markets react negatively to poor economic data is a positive, as it indicates markets are less and less dependent on the Federal Reserve’s policies.

“ Data today were terrible and point to fragility of the U.S. economy, but markets know that the Fed is still likely to raise rates this year as labor market keep improving,” Gaffney said.

Gaffney said any mention of the strong dollar in the Fed minutes would be interesting.

“We know the Fed thinks deflationary pressures due to oil plunge are transitory. It would be interesting to see if they mention anything about the dollar, even though there is probably not much they can do about it,” Gaffney said.

Despite Wednesday’s retreat, the S&P 500 held above certain resistance levels, challenging bearish investors. Jason Hunter, technical analyst at J.P. Morgan, wrote that he is not looking for a definitive move higher from the S&P 500’s current range, despite recent gains that have propelled the benchmark index to record levels.

“While the market can advance further, our broader outlook for a mostly range-bound first half still stands,” Hunter wrote.

Data: U.S. wholesale prices posted a record 0.8% decline in January after an unprecedented drop in energy costs, the Labor Department said Wednesday. The drop was larger than expected. Meanwhile, construction on new U.S. homes dropped 2% in January to an annual rate of 1.07 million units, as heavy snowfall hindered builders in some regions such as the Midwest and Northeast. The numbers matched consensus forecast of economists polled by MarketWatch.

Industrial production rose a seasonally adjusted 0.2% in January, the Federal Reserve said Wednesday. Economists polled by MarketWatch had expected a 0.4% rise. Another sign of weakness came in a slight downward revision to output in the past four months.

FOMC minutes: The minutes from the Federal Open Market Committee’s meeting on Jan. 27-28 are due at 2 p.m. Eastern. At the meeting, Federal Reserve policy makers told investors they would be “patient” about hiking short-term interest rates, and market participants will scrutinize the minutes to see whether any of the top Fed officials actually wanted to drop that phrasing.

The above post by MarketWatch is important because what the Federal Reserve does with interest rates is key to gold’s short term direction. For now anything else is window dressing.

This is our usual ETF Wednesday information – Gold Exchange Traded Funds: Total as of 2-4-15 was 53,717,134. That number this week (2-18-15) was 53,915,389 ounces so over the last 2 weeks we gained 198,255 ounces of gold.

The all-time record high for all gold ETF’s was 85,112,855 ounces in 2013. The record high for Gold ETF’s in 2015 is 54,094,507 and the record low for 2015 is 51,361,279.

All Silver Exchange Traded Funds: Total as of 2-4-15 was 616,761,293. That number this week (2-18-15) was 617,954,299 ounces so over the last 2 weeks we gained 1,193,006 ounces of silver.

All Platinum Exchange Traded Funds: Total as of 2-4-15 was 2,620,475 ounces. That number this week (2-18-15) was 2,565,794 ounces so over the last 2 weeks we dropped 54,681 ounces of platinum.

All Palladium Exchange Traded Funds: Total as of 2-4-15 was 2,998,549 ounces. That number this week (2-18-15) was 2,989,402 ounces so over the last 2 weeks we dropped 9,147 ounces of palladium.

The New Call Rate is up! I just made that name up but the principle behind the made up name is worth remembering if this market is getting on your nerves. Yesterday the percentage of brand new or first time callers jumped – high enough that Harry suggested these lower prices are bringing in new customers. This is true of all markets but just because prices are moving lower does not mean new customers simply appear. As a matter of fact a lower price schedule in gold usually chills the across the board action. But this time around there is new interest – whether they buy is another question but for now I will settle for renewed interest.

From a reader: “Read your newsletter every day. Certainly world events and USD strength currently are driving gold prices. My question to you is; will not any Fed interest rate hike reverberate negatively throughout the US economy? Resulting in PM price increases. Including brief comments regarding economic implications of FED actions on PM’s pricing would be helpful. More Silver discussion would be nice too.”

Yes, any significant interest rate hike will have economic consequences but the Federal Reserve will not raise interest rates until the push-back is small relative to the economic volume numbers. That’s how they get away with quantitative easing – it has consequences but not today. Whether or not such action will push prices higher for the precious metals is questionable. In most cases the higher interest rate will attract more investor money because gold does not pay interest and so cannot compete on the shorter term. What will push gold prices higher is inflation eventually caused by a loose money policy. Inflation however remains very subdued – most of the world is now worried about deflation. When will inflation return? When the normal money cycle returns and bank lending reverts back to its old ways? I think the inflation numbers will remains subdued well into 2016 and the hyperinflation nonsense does not hold any water with me at least.

This from Kira Brecht (Kitco) – Central Bank Gold Purchases Surge To Second Highest Level In 50 Years – Central banks around the globe continued to gobble up gold to add to their reserves in 2014 purchasing a total of 477 tonnes, which is a 17% jump from 2013, according to the World Gold Council.

It was the second highest year of central bank purchases in 50 years.

Russia was the stand-out buyer in 2014, as the country added 173 tonnes to its reserves. Now, Russia holds over 1,200 tonnes of gold and is the sixth largest holder of gold in the world. “They have been buying 10-25 tonnes per month over the last five to six years. The Russian central bank continues to show they are looking to continue that,” said Ashish Bhatia, director of central banks and public policy at the World Gold Council.

Other notable buyers of significant size last year included Kazakhstan (48t), Iraq (48t), and Azerbaijan (10t), the World Gold Council said.

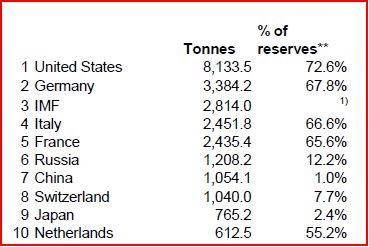

Here is a list of the top 10 largest official gold holders as of February 2015:

Source: World Gold Council, International Financial Statistics

The central bank buying in 2014 marked the fifth consecutive year in which central banks were net buyers of gold, which is a significant sea-change from just a decade ago.

“Central banks were net sellers for almost 20 years, but that changed in 2009-2010,” said Bhatia.

What is behind the strong appetite for gold among the world’s central banks? Bhatia pointed to two main reasons.

First, “central banks are buying gold because of heightened economic and financial uncertainty. The global economy remains on very fragile ground with growth in Europe, Japan and emerging markets stagnating,” Bhatia said. “Yields in major economies are declining. Around the world we are seeing monetary policy continue to ease amid a serious deflation threat.”

The second major driving factor behind central bank gold purchases are relative under-allocation to gold by emerging market central banks, said Bhatia.

The United States and Germany – the world’s largest official gold holders possess roughly 70% of their reserves in gold.

“The advanced economies of Europe and the U.S. have large allocations to gold largely because of the legacy of the gold standard. Emerging market economies weren’t a part of that era. They are not part of that legacy of the gold standard,” Bhatia explained.

Over the past five years, Bhatia noted that China, the Philippines, Mexico, Korea Brazil and Russia have all been adding gold to increase their allocation to gold relative to foreign currencies.

Bhatia added that Mexico and Korea have both added about 100 tonnes of gold to their reserves over the last five years, a sizable amount.

Through research Bhatia has conducted at the World Gold Council, it has been determined that “optimal allocation” for an emerging market central bank to gold is between 4-10%.

Looking ahead, Bhatia believes that “emerging markets will continue to be strong buyers, with Asian central banks standing out as being under allocated within that group.”

“Asian central banks tend to have large foreign currency reserves and relative strong gold reserves,” he noted.

In 2015, the World Gold Council expects central banks to be net buyers for the sixth year in a row with more than 400 tonnes of purchases in gold.

The walk-in cash trade was again slow today and so were the phones – even with the last minute bounce in the price of gold.

The GoldDealer.com Unscientific Activity Scale is a “ 3” for Wednesday. The CNI Activity Scale takes into consideration volume and the hedge book: (last Thursday – 3) (last Friday – 4) (Closed Monday) (last Tuesday – 3). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are increasing – it would indicate things are busier – decreasing numbers over time would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash.

In addition to our freshly ground coffee we offer complimentary cold bottled water, cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy accusation.

Thanks for reading – we appreciate your business. Enjoy your evening!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.