Commentary for Friday, Jan 29, 2016 (www.golddealer.com) – Gold closed up $1.20 at $1116.80 in another round of ho-hum trading but it did end the week up $19.00. Which is not much considering the FOMC stood-pat on interest rates and released information that suggests they are “watching the numbers” when most understand they will not do anything as long as the world continues to sweat China and the EU.

But crude oil pushes higher and so does the dollar – and gold did not fade so that counts for something. The Dollar Index closed yesterday at 98.59 and today has traded between 98.58 and 99.83. We are now around 99.71 so significantly stronger – these two factors present a considerable challenge for the price of gold.

Crude oil surges – this from FX Empire “The very pessimistic situation was uplifted by a glimmer of hope. Major oil-producing countries, including Saudi Arabia and Russia, which were previously disinclined to agree upon a cut in production to support prices, have begun to feel enough pressure to at least talk about the possibility of limiting current output levels. According to Russian Energy Minister Alexander Novak, Saudi Arabia has proposed up to a 5% reduction in output by each oil-producing nation. Also proposed was a meeting among oil and energy ministers of both OPEC and non-OPEC nations to discuss the situation.

On this news of potential cooperation after so many months of non-cooperation, the initial knee-jerk reaction was swift and substantial. Brent crude surged briefly above $35, establishing a three-week high, before paring those gains as the news settled in. The high that was reached was right at the key 50-day moving average, and closely approached major resistance around the $36 level.”

The best you can say about this market is that gold is not going down – but it is not going up either. Actually the price of gold is always lampooned when trading ranges narrow but being at the lower end of an unwinding market creates expectation.

The price of gold topped in August of 2011 ($1825.00) and sadly has been pushed steadily lower now for more than 5 years. The good part of this story is that beginning in the summer of 2013 the “drop” began to moderate – so for 3 years gold has moved from around $1400.00 to both sides of $1200.00 to our most current trading range – something between $1050.00 and $1100.00.

So from a technical standpoint the very short term now favors the bulls – but in the very long term the technical picture remains negative. But here is the thing – all markets are cyclical meaning if you wait long enough the price direction will be in your favor. And this theory for now is working in gold’s favor.

It has been a long time since everyone was on board and many of the other markets which have attracted capital are rocky – stocks for example are having a tough time and with super low interest rates the notion of parking your cash in the bank does not make sense.

So there is now more talk of a gold bottom and perhaps more financial hedging in the physical gold market. The general public is not on board as yet, just look at the historical lows in the gold exchange traded funds. But it does not take much to bring them on board especially if the red ink continues on Wall Street and in China.

The signals however remain mixed – today will be the third or fourth day that the DOW has moved higher in the triple digit range – this does not look defensive to me. At the same time the Bank of Japan announced today it will adopt a negative interest rate policy for the first time in another attempt to jump start business. Considering they have had their own brand of quantitative easing for years it’s surprising no one is making more of this upside down financial model but Wall Street went crazy over the announcement – up 200 points.

Europe is in the same bag – it’s a kind of Goldilocks story – not too cold and not too hot – but this has been the case for some time and they too continue to inflate.

None of these cases will make the ultimate argument for getting back into gold or increasing your current holdings – but all of them together do point to the possibility that 2016 presents a real bottom for gold.

And this “bottom” scenario is most conservative – if something goes wrong with all this economic tinkering or if the Janet Yellen team can’t figure out a way to get back to a

“normal” interest environment the price of gold will double.

Silver closed unchanged at $14.23.

Platinum closed up $6.00 at $872.00 and palladium closed up $6.00 at $497.00. Platinum is trading for $244.00 less than gold.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 6 believe gold will be higher next week – 5 think gold will be lower and 1 thinks it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 41 people thought the price of gold would increase next week – 46 believe the price of gold will decrease next week and 13 think prices will remain the same.

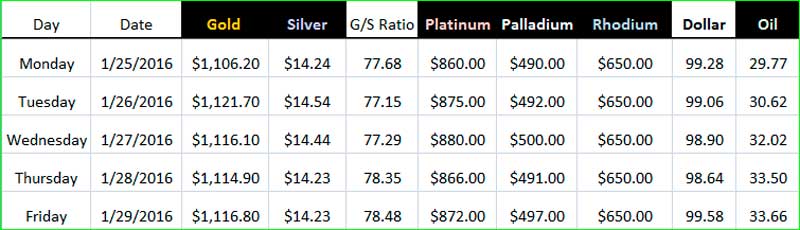

Precious Metal Closes & Dollar Strength – Jan. 25 – Jan. 29

This from Myra Saefong – The gold market just lost its best measure of Chinese demand – The Shanghai Gold Exchange has stopped publishing its weekly gold withdrawal figures, forcing the market to lose its “best measure of Chinese wholesale demand,” according to Koos Jansen, precious-metals analyst and blogger for Singapore-based bullion dealer BullionStar.

Jansen, well known for his analyses on the Chinese gold market, pointed out in a blog Jan. 26, that the SGE’s Chinese Market Data Weekly Reports on the first two trading weeks of this year don’t list gold GCJ6, +0.12% vault withdrawal figures. He said the SGE told him those figures will no longer be published.

“SGE withdrawals provided a unique transparent metric for Chinese gold demand and [they’re] gone,” said Jansen in his blog. They provided a “spy-hole” to track the Chinese gold market.

There are rules and tax incentives in China that “push all physical gold supply to be sold over the SGE. The amount of gold that is withdrawn from its vaults equals physical gold demand,” he told MarketWatch, by email.

The market can only guess why China decided to stop publishing the data. But Jansen suggested that with the withdrawals from the vaults of the SGE being watched by an increasing number of analysts around the world, “the Chinese judged these figures had become too sensitive and discontinued publication since January 2016.”

Similarly, Julian Phillips, founder of and contributor to GoldForecaster.com, said the “significance of the hiding of accurate figures in China” is to prevent that picture of the gold market “from inciting speculators and investors outside of China from buying gold on the back of Chinese demand.”

It’s an “attempt to muddy the waters of the gold market, while China takes control of that market,” said Phillips.

China has a history of holding back gold data. Back in July, the People’s Bank of China published figures on its gold reserves for the first time since 2009. Read: China finally says how much gold it has, but nobody believes it

Whatever the reason for the lack of SGE withdrawal numbers, the fact that China stopped publishing the data “once again strongly confirms the importance of these numbers from the past,” Jansen said.

Brien Lundin, editor of Gold Newsletter, pointed out that mainstream industry groups like GFMS, Metals Focus, CPM Group and the World Gold Council “never recognized this data in the first place so this will, in essence, be a nonevent for them.”

Koos explained in a blog last year that figures on Chinese gold demand from Western consultancy firms differ from the SGE vault withdrawals because of “contrasting metrics.”

Even so, “for those of us who placed great confidence that SGE withdrawals reflected domestic Chinese demand, it will be a great loss,” said Lundin.

The walk-in cash business again showed signs of life today and so did the phones. I would not say things are buzzing but we now don’t have time to consider a big lunch.

The GoldDealer.com Unscientific Activity Scale is a “ 3” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 3) (Tuesday – 3) (Wednesday – 3) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”. Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

Thanks for letting us know when you move or change your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading, as always we appreciate your business and enjoy your weekend.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisors. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.