Commentary for Friday, March 13, 2015 ( www.golddealer.com) – Gold closed virtually unchanged today on the Comex up $0.50 at $1152.60 and overnight trading in both Hong Kong and London was only slightly higher so gold looks quiet and sleepy. On the week gold was down $12.00 – not bad considering all the ruckus.

Actually it’s pretty amazing – Producer Prices reported down 0.5% after a predicted increase of 0.2% so inflation is sleeping and oil fell sharply – down $4.00 to $45.00 so anticipated weakness has arrived – this continues to help the inflation number and hurt the price of gold in the process.

But our sales of PAMP Swiss gold bars are moving up nicely so investors are beginning to think that prices are cheap enough to at least test the waters.

Still gold was firm in face of the mighty dollar today – this is semi-encouraging because the dollar could continue higher. Thursday the trading range in the Dollar Index was 98.65 through 100.06 and today we are looking at 99.20 through 100.39 – as of this writing the index is 100.36 – under any other circumstance gold would be down considerably. I will take this as a short-term win meaning price support for gold is holding. Here is the reasoning – on the year the Dollar Index is up 10% but gold is only down 2%. But keep an eye on last year’s low close of $1142.00 if you are looking for a mischief number.

Silver closed down $0.12 at $15.47 – also quiet today. Silver was lower on the week by $0.31 so we are flattening out in this range. Considering the last few times we have moved below $16.00 I am surprised there is not more action.

Platinum closed unchanged at $1115.00 and palladium was up $2.00 at $788.00.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 6 believe gold will be higher next week – 3 think gold will be lower and 4 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 56 people thought the price of gold would increase next week – 40 believe the price of gold will decrease next week and 4 thinks prices will remain the same.

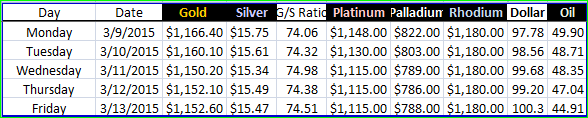

Precious Metal Closes & Dollar Strength – March 9 – 13

The Gold Picture – If you look at the 30 day gold price chart it’s easy to see why gold is vulnerable and technically weak especially considering the dollar surge and potential interest rate hike by the Federal Reserve. During the last 2 months the price of gold in dollars has moved from $1230.00 to $1150.00 with virtually no relief rally so the bulls rule and the short trade is making a great deal of money. But remember the short paper must cover those positions to get a pay check so a bounce to higher ground – is a pretty sure bet.

The gold price picture becomes a little more encouraging when you widen your view to the 6 month chart. I’m not saying we are out of the woods – we are not – most analysts are neutral to negative because during that 6 month period gold fundamentals have changed – key events like no more US QE – better economic numbers equating to higher interest rates – lower ETF interest.

If you throw out gold’s latest big run above $1300.00 earlier this year it has traded in a band between $1240.00 and $1140.00. The negative here is that gold melted through what was solid support between $1220.00 and $1180.00 on this most recent move to the downside. The positive news is that we continue to bounce off the $1140.00 support line.

So has gold put in a bottom? Well that’s the big question isn’t it?

Anti-gold rhetoric is again pervasive (Kitco) “Gold Doesn’t Have the Allure Anymore – TD Securities – Why Washington May Hurt Gold – HSBC – Gold Market Still Negative Despite Some Short Covering – RBC’s Gero”. While all of this may sound bad it is just what gold needs to finally make that bottom. All the naysayer’s line up and the worst investment in the world is gold – the best will be stocks at all-time highs.

This is always the pattern – sentiment goes negative – stays negative and we finally look at all sellers. The bottom my friends – this is exactly the time to enter the gold market. Not all at one time but take advantage of successive lows – when the stock market was heading toward 6000 during the financial panic of 2008 Warren Buffet added to his already huge position. I don’t know what he is buying now that stocks are at all-time highs but it may not be much preferring a more value orientated approach.

You have to go back 5 years to see that $1200.00 was important for gold. On 4 different occasions we bounced off that number to higher levels. But this time around that pattern broke down so caution is necessary.

Physical gold demand across our counter and gold Exchange Traded Fund levels have not been robust even at these lower levels. This week’s ETF number – 53,514,021 ounces held – the low point in the number of ounces held in all these funds during 2015 was 51,057,082.

So there is some improvement but it’s tepid. The picture improves, at least in my mind when you look at all-time ETF highs (2013) 85,112,855 ounces. Granted we are down substantially but considering all the negative news we could be doing much worse especially with the stock market making new recent highs.

So all in all it is a mixed relative bag with traders waiting for the next shoe to drop. It certainly will continue to test recent lows and a break to the downside here could get ugly but let’s not jump out the window.

We could just as easily be trading the solid 6 month pattern – an up and down channel between $1140.00 and $1240.00. As gold waits for inflation numbers to creep higher – a possibility – this morning on CNBC they talked about no real estate supply and rising pricing. And our friends in Europe began printing away last Monday. Do I fear an inflation spike? Of course not all the indicators show inflation is dead – but for how long?

Gold by any fiat monetary standard is cheap and getting cheaper relative to the amount of paper money being created out of thin air. Cause and effect in this scenario is always lagging – so the end of the story is yet to be told. Finally physical demand especially from India and China heats up dramatically as gold trends lower and this transfer of gold from the West to the East will at some point reach a tipping point which favors higher prices.

This from Jim Rickards (The Daily Reckoning) – Three Catalysts for the Price of Gold – “Investors have long understood that gold is an excellent hedge against inflation. The analysis is straightforward. Inflation is caused, in part, by excessive money printing by central banks; something central banks can do in unlimited amounts. On the other hand, gold is scarce and costly to produce. It emerges in small quantities.

The total growth in global gold supplies is about 1.5% per year and has been slowing lately. Compare this to the 400% growth in base money engineered by the Federal Reserve since 2008, and it’s easy to see how a lot more money chasing a small amount of gold will cause the dollar price of gold to rise over time.

But this is not the only driver of higher gold prices. There are at least three other catalysts – extreme deflation, financial panic, and negative real interest rates. A brief look at all three scenarios will give us a more robust understanding of gold’s potential price performance.

Mild deflation might cause the nominal price of gold to decline, although it may still outperform other asset classes that go down even more. But extreme deflation, say 5% per year or more over several years, is a central bank’s worst nightmare.

This kind of deflation destroys tax collections because gains to individuals come in the form of lower prices, not higher wages, and governments can’t tax low prices.

Deflation also increases the real value of debt, which makes repayment harder for individuals, companies and governments. As a result, defaults increase and those losses fall on the banking system, which then has to be bailed-out by the Fed.

This lethal combination of lower tax revenues, higher debt burdens, and failing banks is why the Fed will fight deflation with every tool at its disposal.

So far, the Fed has been trying to fend off deflation by using its inflation playbook including rate cuts, money printing, currency wars, forward guidance, and Operation Twist. All of this has failed. Deflation still has the economy in its grip. But when all else fails, central banks can cause inflation in five minutes simply by voting to fix a gold price of, say, $3,000 per ounce.

The Fed could make the price stick by buying gold at $2,950/oz. and selling it at $3,050/oz., in effect becoming a market maker with a 3.3% band around the target price.

If the Fed did this, all other prices including silver, oil, and other commodities would quickly adjust to the new price level causing 150% general inflation – problem solved! Don’t think of this just as an “increase” in the price of gold; it’s really a 60% devaluation of the dollar measured in gold.

If this sounds far-fetched, it isn’t. Something similar happened twice in the past 80 years; in 1933-1934 and 1971-1980.

The second scenario for higher gold prices is financial panic. This does not rely on any technical economic analysis; it’s a simple behavioral reaction to fear, extreme uncertainty and investor aversion to loss. When panics begin gold often declines slightly as leveraged players and weak hands dump it to raise cash to meet margin calls.

But, quickly the strong hands emerge and gold rallies until the panic subsides. It may then plateau at the new higher level, but the objective of preserving wealth when other asset classes may be in chaos has been accomplished.

The third driver of higher gold prices is an environment of negative real interest rates. This is a condition where the rate of inflation is higher than the nominal interest rate on some instrument. I use the ten-year Treasury note for this comparison.

Right now real rates are steeply positive since ten-year note yields are about 2% and inflation is slightly negative. This is a headwind for gold, but the Fed is determined to cause inflation while keeping a lid on Treasury rates with financial repression. The Fed wants negative real rates to encourage “animal spirits.” Investors know that it’s usually not smart to fight the Fed. In any case, the Fed will keep trying, which could make asset bubbles worse.

So gold does well in inflation, extreme deflation, panic, and an environment of negative real rates. Is there a scenario where gold does not do well? Yes. If the Fed brings the economy in for a soft landing, achieves trend growth of 3% or more on a sustained basis, avoids deflation, avoids inflation and engineers a positive sloping yield curve with positive real rates, then gold will have no immediate reason to rally. Is this possible?

Yes, but highly unlikely. Deflation is the immediate danger. Fighting deflation probably means overshooting on the inflationary side next. Bubbles are everywhere and could burst leading to panic at any time.

Trend growth will not resume without structural changes to the economy that are precluded by a dysfunctional political system in Washington. Even if the Fed’s rosy scenario did emerge, gold could still rally based on foreign buying, diminished floating supply of physical bullion, and the potential for a short squeeze.

In short, a balancing of all of the possible financial outcomes from here argues strongly for including gold in your portfolio at this entry point. There are many ways to own gold or have price exposure to gold including physical bullion, ETFs, derivatives, gold miners and gold royalty trusts.

I recommend you have a 10% allocation to physical gold if you don’t already. More specifically, American Gold Eagle or American Buffalo gold coins from the U.S. Mint. Storage should be with a reliable, insured, non-bank vault near your home or in a home safe. The best security is not to let anyone know you have the coins in the first place.”

The walk-in cash trade was rather hot today – plenty of action with no large sellers. The phones were again just average. Again our sale of gold bars is moving higher.

The GoldDealer.com Unscientific Activity Scale is a “ 7” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 4) (Wednesday – 9) (Thursday – 8). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy question.

Thanks for reading – we appreciate your business. Enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.