Commentary for Tuesday, May 13, 2014 – Gold closed down $1.00 at $1294.60 so not much action today but it still manages to hold the upper end of its current trading range on virtually no new news and no buzz. Even at gold’s low on the day we were off only $6.00 so we are sleeping here folks. Even retail sales coming in at less than expected (up 0.1%) did not move the needle.

Gold continues to trade in a sideways pattern despite many factors that might otherwise pressure prices. Those factors include a recent drop in the euro (stronger dollar), continued taper by the Fed, record short positions in silver, less immediate tension in Ukraine, all-time highs in equities, disappointing Chinese economic numbers and the still closed gold window in India. But on the year gold is up 7.7% which means the true believers in the physical market are front and center. If you want to add some gold to your collection the American Gold Buffalo 1 oz is a great choice.

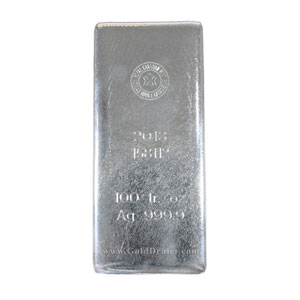

Silver was also pretty boring closing unchanged on the day at $19.50. There is some talk about “backwardization” in silver futures perhaps leading to future shortages. This number inversion happens occasionally when the current month trades at a higher price than future months. It could also mean there is large short position but there is something odd with the paper trading market. I would not make too much of this but there is plenty of action on the physical side below $19.00. The popular item in silver today was the RCM 100 oz Silver Bar.

Platinum closed up $14.00 at $1455.00 and palladium closed up $9.00 at $817.00. The Platinum Group Metals (PGM’s) have been solid of late because they are seen as cheap relative to gold by the physical market. Also problems in Russia have led to speculation relative to mining, and a recovering world economy will need more platinum, palladium and rhodium for expansion. Palladium’s close today ($817.00) is within a $1.00 of a multiyear high ($818.00).

Chuck Butler (Everbank) is always worth a read: So, that’s the Big Kahuna data that’s due this morning in the U.S. Overnight, China printed some interesting data, let’s go to the tape for the results.. Chinese April Industrial Production printed at +8.7%, down from March’s +8.8%, and down from expectations of +8.9%. April Retail Sales were strong at +10.9% VS last year, for the third straight month. So, Retail Sales show strong domestic activity, but the overall feel in China is that the economic slowdown continues. I know that I said a few months ago that I thought we would see that the last quarter represented a trough for the Chinese economy, and that might still be the case, but now I see brokers like Barclays are marking down their forecasts for 2nd QTR growth to 7.2% (from 7.4%). The Chinese were in no mood to appreciate the renminbi / yuan overnight, so that currency led the way for dollar strength in Asia, and that spread to the S. Pacific, and then into Europe. But there are some shining stars in all the dollar strength this morning, so let’s talk about them, for that will be like painting happy trees! On a sidebar, do you remember the artist that the kids all loved that used to say he was painting happy trees? Great memories. The Chinese renminbi / yuan is close to “fair value” according to SAFE (state administration of foreign exchange). the Peoples Bank of China (PBOC) Gov. Zhou, was reported this past weekend as saying that no large scale measures will be used to stimulate or boost growth, and then Chinese President Xi, said that the nation needs to adapt to a “new normal” pace of growth. Do you think we need to take all these things together, and come to the realization that the Chinese economy has slowed from its boom days, which could mean a big slowdown of renminbi /yuan appreciation? Well, not if you’re the U.S. Sec. of State, who said that the recent moves by the Chinese to weaken the renminbi / yuan are “unacceptable”.

I post this not because the numbers are surprising – everyone should get used to this new idea of “growth” in China. And to place China alongside the usual definition of the modern normal (growth rates of 2% to 3%) is to make the mistake most are making which is to short-change the Chinese “plan”. These folks will continue to buy physical gold based on their reinvention of their business model. So get used to it and disregard the naysayers which claim “over growth” or “over stimulation”. The only thing that will be “over” with China and India is the “over the top” prescription for more gold and silver.

This presentation by Lawrence Williams Zurich (Mineweb) is excellent because it presents “balance”, meaning it is not some wild correlation between gold and the “ante’s” which will make you rich. It does provide a solid look at what the near term looks like to professionals. The opening keynote on the second day of the Denver Gold Group (DGG)’s European Gold forum in Zurich was given by Philip Newman of Metals Focus – a new analytical rival for Thomson Reuters GFMS primarily set up by former GFMS employees. Metals Focus also put out a new 60-page report on the Gold and silver markets today, in conjunction with the DGG and Swiss precious metals refiner, Valcambi. In his address, Newman primarily focused on the outlook for gold and silver demand. – GOLD DEMAND – The two key categories for gold demand (ignoring central bank sales or purchases and hedging/dehedging) are jewellery and investment and increasingly, Newman pointed out, both these are nowadays being dominated by China and India – particularly the former which has come from virtually nowhere only five years ago to being the world’s leading gold consumer in 2013. In the global gold jewellery market these two nations now account for almost two thirds! For gold investment, emerging markets in general (of which China and India are the two biggest contributors) comprised about 80% last year although Newman feels that 2013 provided perhaps an unrealistically high benchmark with Chinese demand in particular being driven by a huge growth in wealth distribution coupled with the big crash in the gold price which occurred in April and continuing weak gold prices throughout the rest of the year which stimulated demand. While he expects Asian demand to remain strong in 2014 Newman cautions that he and his colleagues don’t anticipate it quite maintaining 2013 levels. To an extent this is demonstrated by big swings in gold premiums on the Shanghai Gold Exchange which at one time reached around $40 last year but fell back to negative in early 2014 as Chinese demand appears to have slipped back from its pre- Lunar New Year highs. Premiums have since recovered to positive again – and it should also perhaps be recognized that Chinese Q1 gold demand has still been in excess of that in the first quarter of the record 2013 year. While demand may have slipped a little on a month by month basis from the latter half of 2013 it thus still remains robust and with the second half of the year tending to be stronger than the first in terms of consumption China could still surprise on the upside. India remains the biggest unknown in terms of demand at the moment with the waters muddied by the import duties and the 80:20 rule which has cut ‘official’ imports quite dramatically, although these do seem to be picking up a little so far this year. However a good proportion of Indian demand may have been supplied by ‘unofficial’ (smuggled) imports and the very high price premiums in the Indian market, which have reached as high as $100 or more – and the massive increase in imports into Middle Eastern centres like Dubai (traditionally a source for Indian imports) would tend to support this view. There is the feeling that the Indian market could be changed by the relaxation of some of the import restrictions post-election, but this is unlikely to happen, if indeed it does, until May at the earliest. Global mine supply, contrary to much market comment that lower prices would see production falls, actually rose around 5% in 2013 as miners ‘reduced costs’ through mining higher grades and as major projects already in the pipeline came on stream. 2014 could see further small growth in new mined gold output, although beyond that the position is less certain with a possible secular production downturn seen from 2015 and beyond as the lower gold prices of the past two years do begin to have an adverse impact and delay, or cancel, new project commissioning. Overall Newman reckoned in his presentation that gold prices, having picked up early in the year, would be largely range-bound in the second half. He saw a best case scenario of gold at around $1,375 this year (which could mean gold has already peaked) and a worst case that the price could fall back briefly to around $1,100. But overall 2014 is seen as a year of price consolidation with relatively limited downside. Gold was seen as being in a fundamental deficit last year, which seems counter to its price performance, although this was perhaps largely due to the decline in investor sentiment. This was shown by the massive offloading of metal from the major gold ETFs at a level which is highly unlikely to be repeated this year with holdings reckoned to now be in stronger hands. – SILVER – Silver has a substantially different market make-up from gold in that industrial demand accounts for around 50% of consumption, making global GDP have a significant impact on performance. As global GDP rises then so should silver demand and there are some strong growth segments in the industrial sector (of which photovoltaics are particularly important) which should counter the nowadays small fall-off in photographic usage. Thrifting (whereby silver is being substituted by cheaper metals or being used in smaller quantities) does have a limited impact, but overall silver’s industrial market remains fairly robust. Silver investment demand may have taken a knock with price declines over the past two years, but sales of American Eagle silver coins have been strong in the first quarter of the current year. Silver mine supply is seen as growing though (up 2% in 2014) and overall investment demand could well slip further which Metals Focus sees as limiting any upside price potential this year. However forecasting gold and silver prices is a pretty invidious business and while fundamentals may suggest little change in prices this year, external geopolitical factors can continue to have a significant impact. Ukraine is not played out yet and could contribute to short term swings, although an assumed end to the crisis at some future point of time could lead to a price fallback. However there are other potential flashpoints around this uncertain world which could also contribute to a resurrection of safe haven demand.

Walk-in cash traffic was off again today but there is something happening with repeat physical buyers. This may sound funny but when a market is flat (meaning we are stuck in a repeat and narrow pricing model) you wonder why big buyers repeat business in a short period of time. The smaller size guy gets bored but when larger buyers show up I wonder and it’s no big deal but why the hurry? The phones were also soft today which figures as stocks make new highs.

The GoldDealer.com Activity Scale is a “4” for Tuesday. The CNI Activity Scale takes into consideration volume and the hedge book: (last Wed – 6) (last Thurs – 4) (last Fri – 6) (Monday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers.

An update on the In and Out Hamburger Wagon in our parking lot idea. Everyone loves a good hamburger and we thought it would be a nice way of saying “thanks” for the business. Anyone with a tax free invoice ($1500.00) can get a free Double/Double on the way out. The truck would be in the parking lot about 2 hours and we would have tables in one corner. The upside to this idea is getting a great hamburger when you make a purchase in person. The downside is that while we have a large lot this idea might create a parking problem. Please opine at RSchwary@aol.com and thanks for the input.

The initial reaction is mixed. Some love the idea and some claim the parking lot can be crowded at times and this idea will create more problems for those who are in a hurry.

So the jury is still out but the most creative answer to our free hamburger dilemma has to go to this reader: First Prize (there really was no prize giveaway but we needed some sort of drum roll) – LOVE the idea of burgers in the parking lot. I can buy bullion to protect against hyperinflation, whilst hyper-inflating my waistline.

Live pricing on the site moves all bullion products up or down during the day. The Bullion Products link on the home page now includes our Bid (blue) and Ask (green) prices. Premium quotes vary with product and look like this – “spot plus $15.00” or “spot plus $50.00” and bullion products list them under the live prices on their respective landing pages.

This makes product comparison simple and GoldDealer.com is the only precious metal site on the internet with this transparency. Live Chat is doing well and new customers like setting up their own encrypted accounts. We recommend upgrading old browsers to Google Chrome (free/secure) especially as our site becomes more advanced.

Sign up for our daily Gold Newsletter on the Gold Newsletter page if you are so inclined. Also note that our old Specials Email list is not compatible with the new format so we have cleared all data.

If you want to be notified about specials please check the Special Offers box under All Bullion Products. Also note that the email list for the Gold Newsletter and our Special Offers are separate.

Email confirmation using a PDF File when buying or selling is functional and includes payment instructions. You can now see the actual invoice or purchase order on your computer screen.

When you buy or sell please check to see if we have your current email on file and that your computer will accept our email (no spam).

Our four flat screens downstairs with live independent pricing (BullionDesk) are a big hit with the cash trade. This live stream moves all buy/sell prices so the cash buying or selling public can see the markets move on a real time basis. Our site uses the same pricing model so no more guessing.

Our Price Beating Guarantee (buying or selling) remains famous so call Kenny (1-800-225-7531) and get more money in your pocket. We guarantee your satisfaction and include our No-Nonsense Policy (NNP) which clients consider a welcomed extra. Like us on Facebook and follow us on Twitter @CNI_golddealer. Thanks for reading and enjoy your evening.