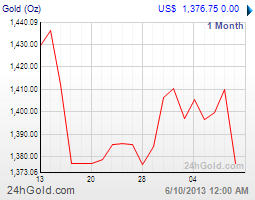

Commentary for Monday, June 10, 2013 – Gold closed a bit higher today up $3.20 at $1386.20 and the dollar reacted positively on news that Standard and Poor’s changed US debt quality from negative to stable but this strength waned and so dollar weakness finally supported higher gold. Still the gold market remains quiet and waiting for further easing news one way or the other.

Silver closed up $0.18 at $21.92 also in quiet trading but the physical market remains active at these lower levels.

Platinum was up $4.00 to $1508.00 and palladium was up $8.00 at $768.00.

This from Bloomberg is interesting: China Approves Gold-Backed ETPs as Domestic Buyers Chase Bullion – China approved two domestic exchange-traded products backed by gold as global holdings of the precious metal in ETPs dropped to a two-year low. Huaan Asset Management Co. and Guotai Asset Management Co. received the China Securities Regulatory Commission’s permission to start the funds, which will be denominated in yuan, said Liu Jianqiang and Li Yebin, spokesmen for Huaan and Guotai. They will be traded like stocks on the Shanghai Stock Exchange (SHCOMP), tracking movements of spot gold on the Shanghai Gold Exchange, Liu and Li said separately by telephone from Shanghai. Buyers in mainland China viewed the rout as a buying opportunity and rushed to purchase jewelry, bars and coins in late April and early May. Gold slid into a bear market in April amid concern the U.S. Federal Reserve may rein in stimulus that helped bullion cap a 12-year bull run in 2012 and as investors reduced holdings in exchange-traded products backed by the metal. “Gold ETFs should help boost gold demand as they will make Chinese investments in the bullion much easier,” Zhang Bingnan, secretary-general of the China Gold Association, said by phone from Beijing today. “The dumping recently of holdings in gold exchange-traded products by overseas investors may not prove to be a wise move.”

Both walk in and phone trade was also on the quiet side today as the physical market may be joining the larger crowd waiting on further news as to when the Federal Reserve might consider tapering its aggressive bond buying program. Thanks for reading and enjoy your evening. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.GoldDealer.com)