Commentary for Friday, May 15, 2015 – Gold closed up $0.10 at $1225.50 but this market is not as flat as it looks. In overnight Hong Kong trading we saw a mild sell-off in prices which moved gold below $2015.00 but the London market recovered and prices firmed into the domestic trade.

Gold has gained $36.00 on the week but there is also something else happening – expectations for higher prices sooner or later are improving – especially among the trade. I would not get too excited here because the gold trade is famously dyslexic. Still there is a whiff of optimism out there which is refreshing.

The dollar is generally flat today but coming off highs – the Dollar Index yesterday closed at 93.39 and the range today has been from 93.20 through 94.00. At the time of this writing it was 93.22 which is about unchanged but the daily trend is weaker coming off 94.00. This could just be transitory – the real metric at work here can be seen in the Dollar Index this past week – we have moved from above 95.00 to almost 93.00 – considerably weaker and this is a major factor in gold moving higher.

The story of why we are a bit more optimistic has been told all week. The latest slate of economic news included low retail sales and falling producer prices. This, at least for some has taken the expectation of a Fed interest rate hike off the table, perhaps for the rest of 2015.

I don’t buy this view but it is getting more traction with reliable traders. The consequences suggest that we have become accustomed to the so-called financial punch bowl. And in fact there is a minority which suggests that the explosion in stock prices is artificial and is the result of this monetary expansion.

All of this remains to be seen but there are storm clouds. The enactment of a near zero interest rate policy in place since the financial crisis (2008) has some traders rattled – especially because the physical market is supported by solid demand from China, India and Central Banks. Not staggering demand – if that were the case gold would be $5000.00 an ounce. But the buying action is steady and over the very long term will not only support the price of gold but might push it much higher especially because of the developing middle class in both China and India.

At any rate this near-zero interest rate policy was supposed to be temporary – that’s what all the fuss is about – how long can we push this cheap money envelope without having the check bounce. Consider that in this merry dance of cheap cash the US government is the largest borrower by a mile and an increase in interest rates will create another economic mess.

Will all of this happen? Probably not – our government will slowly raise the cost of money over the next few years. But could something seriously go off the tracks – sure – we have never created this much money out the thin air before. That is why the price of gold is so erratic.

Silver closed up $0.09 at $17.54. Sales of the usual products – 100 oz bars and US Silver Eagle Monster boxes are steady but not accelerating. Silver was up a substantial $1.10 so some profit taking might be expected but keep in mind silver is now at the highest point since February and we are reasonably close to that magic high on the year of $18.30. If we break above this number silver might run. The great thing about silver bullion is that in the very long term this market has been a tale of feast or famine. Investors are either all in or all out – and if silver once again runs to the upside believe me everyone and their brother will be all in.

Platinum closed up $7.00 at $1168.00 and palladium was up $15.00 at $795.00. Platinum remains at a substantial discount ($57.00) to gold. Availability of physical product continues to improve but keep in mind that there is not a great deal of anything out there. If you wanted to trade 1000 ounces of gold bullion for 1000 ounce of platinum bullion and were product specific the story would be recounted between larger dealers the following morning.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 12 believe gold will be higher next week – 1 thinks gold will be lower and 3 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 53 people thought the price of gold would increase next week – 32 believe the price of gold will decrease next week and 15 think prices will remain the same.

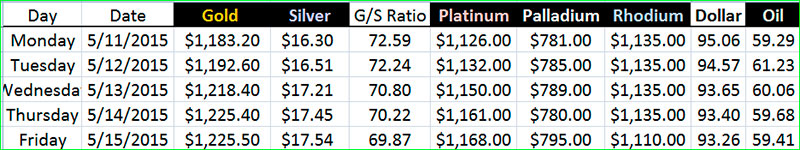

Precious Metal Closes & Dollar Strength – May 11 – May 15

This from Tom DiChristopher (CNBC) – Cashin: No ’15 hike, but Fischer will keep investors guessing – Art Cashin counts himself in the camp that sees the Federal Reserve pushing an interest rate hike out to 2016, but one member of the Federal Open Market Committee could inject uncertainty into the process, he said on Friday.

The director of NYSE floor operations for UBS told CNBC’s “Squawk on the Street.” that Fed Vice Chair Stanley Fischer could leave investors guessing as to when the central bank will lift rates.

“Stanley Fischer is going to be a very big influence on the FOMC, and he wants to introduce surprise into the game,” Cashin said. “He wants the markets not to feel self-assured, and he thinks that that will cause the markets to prediscount things.”

The Fed is expected by some to raise its benchmark interest rate—which has been near zero since December 2008—by 25 basis points in September.

Fischer will try to push the FOMC to “at least appear” to be ready for liftoff, he said.

However, soft data is making the market feel better, he added. The Fed has said it will hike rates once economic data indicate the U.S. economy can sustain an increase.

Government data crunchers have delivered markets a string of disappointing reports this week. Retail sales were flat, and both industrial production and producer prices fell in April. On Friday, the University of Michigan reported consumer sentiment dropped to a seven-month low.

Those reports are keeping alive the prevailing notion that bad news is good news, Cashin said. Poor economic numbers are seen propping up equity markets because they encourage the Fed to keep interest rates low. That decreases the cost of borrowing for U.S. companies and pushes investors toward stocks rather than low-yielding bonds.

“The light data is helping to some degree. You’ve got the [10-year Treasury] yield down below 2.2 percent. You had all that Treasury refunding this week, so the big supply is out of the way,” he said, referring to the U.S. bond auction.

He continued to say, “We were all hoping—the bulls were hoping, certainly—that if you broke out of this narrow range you’d inspire some short covering, some follow-through, some sideline money. None of it has come about. This is a very, very disappointing breakout.”

Equity markets can rally substantially from present levels if indeed the Federal Reserve delays a rate hike, Cashin said, though companies need to continue to deliver positive earnings.

This from Kira Brecht (Kitco) – Central Banks, Asian Consumers Remain Committed Gold Buyers – “Asian consumers and global central banks continue to act as a long-term underlying support to the gold market with on-going physical demand. The latest data from the World Gold Council revealed solid purchases by central banks in the first quarter 2015. Price weakness in gold in recent weeks has also attracted fresh buying interest from Chinese and Indian consumers as a pick-up in gold exports from Switzerland to China has been noted.

Consumers in India and China now account for 54 percent of all global consumer gold demand, according to the World Gold Council. These buyers have proven to be price-sensitive and have emerged on gold price weakness in recent years. In June 2013 and January 2014, a strong bout of physical gold demand emerged on price dips below $1,180 per ounce. More recently, the floor has fallen a bit toward the $1,140-$1,130 region.

Gold remains buffeted between the conflicting bullish forces of long-term central bank and consumer investment demand and bearish concerns about the potential for U.S. Federal Rate hikes. For now, central banks and Asian consumers are using the recent price retreats in gold as buying opportunities.

“The recent weakness in the gold price has seen a return in physical demand from key emerging markets. Gold exports from Switzerland to China doubled in March, offsetting an 18% y/y fall in China exports from Hong Kong. In addition, Switzerland’s exports to India rose suggesting a pick-up in physical demand from the two biggest consumers,” according to a Capital Economics research report.

Beyond Asian consumers who are expected to have a long-term and growing appetite for physical gold as their middle class and economies continue to grow, central banks continue to purchase gold for official reserves.

In the first quarter 2015, central bank purchases totaled 119 tons, which marks the 17th consecutive quarter in which central banks have been net purchasers, according to the World Gold Council. Central banks continue to attempt to diversify their official reserves and in recent years gold has been an integral part of their strategy.

In the first quarter, Russia purchased over 30 tons of gold, in addition to Kazakhstan at 6.6 tons, Belarus at 2.1 tons, Malaysia at 2.1 tons and Mauritius at 1 ton, the World Gold Council said.

Looking at recent action in the gold market, the yellow metal has bounced strongly off its March low around $1,142 per ounce. The near term technical picture is beginning to improve as June Comex gold futures trade above many key moving average lines. The market is testing the $1,225 per ounce area, which is an important ceiling in the short-term. If sustained gains are achieved above $1,225 in the days ahead it would improve the intermediate term trend outlook for gold and open the door for upside probing back toward an initial target around $1,246.50.

Once again, long-term physical buyers of gold have limited downside pressure on the yellow metal.”

The walk-in cash trade today was steady and so were the phones – there is some tension in the air however judging by the questions from the public. This is great – no matter what the market does next week because interest trumps price – usually.

The GoldDealer.com Unscientific Activity Scale is a “ 5” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 2) (Wednesday – 5) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.