Commentary for Friday, Feb 27, 2015 – Gold closed up $3.00 on the Comex today at $1212.60 – underwhelming really considering we were up as much as $11.00 at one point in early trading – on the week gold was higher by $8.00 and this is the first weekly advance in 3 weeks. The Gross Domestic Product for the 4 th quarter was announced up 2.2% – not stunning but consistent with growth – Q3 was up 2.8%.

Silver closed down $0.07 at $16.51 in quiet trading and this soft number is representative of our across the counter action.

Platinum closed up $12.00 at $1185.00 and palladium was higher by $9.00 at $819.00.

Oil seems firm – steady on the 1 day chart and bouncing higher on the 5 day chart – we have moved from $51.00 a barrel to $48.00 – bouncing back to $49.00. Steady to higher will support gold but I expect further volatility here with a wider trading range.

The Dollar Index at this writing is 95.16 somewhat weaker and off its highs of 95.36 – so weaker but not enough to get excited about and certainly not strong enough to account for today’s higher prices.

So neither the dollar nor oil are accountable – still the gold market is firm – this strength might be coming from account squaring going into the weekend perhaps the short trade is nervous. And now that the Federal Reserve is not going to raise interest rates on the short term the mood of the physical market is moving away from negative back into neutral. China and Asian markets are coming back to life and we have seen a big jump in the PAMP gold bar market across our counter so higher gold prices are probably the result of some safe haven buying.

In the bigger picture however the physical market is not ready to get out the party hats. Let’s say the immediate tension of a rate hike is behind us but the prime mover for higher gold prices is still absent. My bet is that we stay range bound and defensive…waiting. The upcoming EU bond buying program may produce some sparks but inflation is still tame and the fear factor has subsided.

Finally just because the fireworks have subsided, don’t think there is not tension below the surface. There is a ton of money action ready to reenter this market at the first sign of trouble. And trouble these days is always right around the corner.

India could change the 10% tariff on gold imports this Saturday at their annual government budget meeting. India has recently made it easier on the physical gold trade through their banks but a change in the high tariff would be very encouraging especially at this pivotal time for gold.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 7 believe gold will be higher next week – 4 think gold will be lower and 1 believes it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 43 people thought the price of gold would increase next week – 40 believe the price of gold will decrease next week and 17 think prices will remain the same.

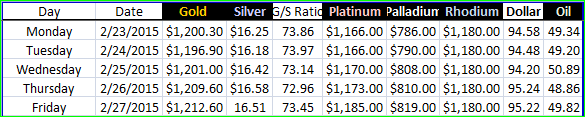

Precious Metal Closes & Dollar Strength – Feb 23 – 27

This week I have been rather brutal on the price of both gold and silver – indicating yesterday that it will take a big game changer to reframe the physical gold market on the short term. The keys to this rediscovery are twofold: renewed interest from the American speculative investor and a dollar which is losing value. My second choice of happy scenarios for the gold bullion buyer is a collapsing stock market. I don’t hold either scenario dearly but in the interest of equal time consider this following from Paul Farrell and gold buffs rejoice.

This from Market Watch Columnist Paul Farrell – It’s time to start the countdown to the crash of 2016. No, this is not a prediction of a minor correction. Plan on a 50% crash. Most investors don’t want to hear the countdown, will tune out. Basic psychology. They’ll keep charging ahead with a bullish battle cry, about how the Nasdaq will keep climbing relentlessly to a new record above 5,048 … smiling as they remember reading that a whopping 73 companies are now in the Wall Street Journal’s Billion Dollar Start-up Club, with Uber ($41 billion), SpaceX ($12 billion) and Snapchat ($10 billion). Hearts race even faster reading in Bloomberg BusinessWeek that “China’s IPO Boom Mints Billionaires” and Jack Ma’s Alibaba fortune is now valued at $35.1 billion.

Yes, technology IPOs are in the lead, and with all that good news, it’s easy to understand why investors tune out, don’t want to hear the warnings, no countdown to the 2016 crash.

But the crash of 2016 really is coming. Dead ahead.

Maybe not till we get a bit closer to the presidential election cycle of 2016. But a crash is a sure bet, it’s guaranteed certain: Complete with echoes of the 2008 crash, which impacted on the GOP election results, triggering a $10 trillion loss of market cap … like the 1999 dot-com collapse, it’s post-millennium loss of $8 trillion market cap, plus a 30-month recession … moreover a lot like the 1929 crash and the long depression that followed.

Plus cycles theorists warn that we dodged a crash in 2012-2013, thanks to the Fed’s stimulus and cheap-money polities. Or rather delayed it, which adds more power to the next one.

Why not sooner, you ask? Why not in 2015? Yes, Mark Hulbert’s already warned that the “stock market risk is higher today than it was in the dot-com era.” Yes, a dip is possible. MarketWatch’s Sue Chang writes of a 10%-20% stock-market correction by July.

But we also know markets are typically up the third year of a presidency. So if no crash is in the cards this year, then why bother with warnings and a countdown? Why bother building up the 2016 elections with lots of dark early warning signs, and doom-and-gloom warnings for the next 18 months?

Why? Simple, behavioral economists have long been telling us that investors will either choose to stay in denial till it’s too late, never having learned the lessons of history when the market collapsed in 2008, 2000 or 1929, when they collectively lost trillions. Or we know some investors really do want to heed the warnings, so they can plan ahead, avoid big losses, and take advantage of opportunities later, at the bottom.

Deja vu 2008: Watch another presidential hopeful collapse!

Let’s compare 2016 with earlier crashes: 2008 to 2000 to 1929, knowing all bulls drop into bears eventually. Basic cycles theory. And this next one will trigger losses bigger than 2000 and 2008. So bet against the house at your peril.

Jeremy Grantham’s already on record predicting that “around the presidential election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse.”

That will translate into the DJIA crashing from today’s 18,117 down 50% to about 9,000. Ouch, the Dow crashing all the way below 10,000. Unimaginable. Bulls will hate it. No wonder our brains tune out, turn off. Instead, we prefer the happy talk that will just keep coming out of Wall Street and Washington till the 2016 collapse. We’ll just keep denying reality … till it’s too late, and we suffer another $10 trillion loss is on the books.

Deja vu 2000: irrational exuberance, dot-com technologies

Remember 1999. Just 16 years ago. Roaring hot “irrational exuberance.” Renewed stock market mania. Wall Street was hot. Stocks roaring. Back then investors demanded insane annual returns during the worldwide millennium celebrations: the top 19 mutual funds had 179% to 323% annual returns.

Yes, dot-com stockholders expected 100% plus returns on zero revenues. Laughed at 30% index fund returns. Early retirement was all the buzz in barbershops and at neighborhood barbecues … Then came the tech crash of 2000. Two wars. A 30-month recession. By 2005, global real estate was a hot new mania. Wall Street, Main Street, all addicted to the next new manias … More is never enough. We’re our own worst enemies.

Skeptics may think this is a joke. Far from it. There’s a huge lesson for all investors in this victory. But we never learn. We’re in denial. Repeat.

Deja vu the Crash of 1929: and the long Great Depression

“The United States is more vulnerable today than ever before including during the Great Depression and the Civil War,” says Thom Hartmann, in “The Crash of 2016.” Why? “Because the pillars of democracy that once supported a booming middle class have been corrupted, and without them, America teeters on the verge of the next Great Crash.” Thanks to an obstructionist GOP, hell-bent on destroying Obama the past six years. His indictment hits hard, but matching something you might hear from Rush Limbaugh on the Right.

“The United States is in the midst of an economic implosion that could make the Great Depression look like child’s play,” warns Hartmann. His analysis is brutal, sees that “the facade of our once-great United States will soon disintegrate to reveal the rotting core where corporate and billionaire power and greed have replaced democratic infrastructure and governance. Our once-enlightened political and economic systems have been manipulated to ensure the success of only a fraction of the population at the expense of the rest of us.” And he wrote that before Picketty’s “Capital in the 21st Century.”

Déjà vu the Crash of 2016: sorry you’ll never hear coming

Why won’t we hear the crash? Are we all deaf? No. In fact, the warnings are always long and loud and crystal clear. So why won’t most investors hear them? Here’s why …

The crashes will just keep coming. On March 20, 2000 we warned: “Next crash? Sorry, you’ll never hear it coming.” But few listened. The 1990’s dot-com’s mania was so blinding, it drowned out rational thinking, led to Wall Street losing $8 trillion in the 2000-2003 bear market recession. Still, nothing much has changed. Another round of warnings roared from 2004 into 2008. Few listened. Then another crash. And Wall Street lost even more, $10 trillion.

Throughout much of 2012-2013, pundits warned how bad the market really was. But in December the Wall Street Journal revealed that after 13 years in negative territory, Wall Street’s “Lost Decade” (which lasted from the 2000 crash to the end of 2013), finally broke even on an inflation-adjusted basis. And investors got back into bullish feelings. And that eased the panic and bought the bulls more time.

Yikes, it took 13 long years to break even from Wall Street’s losses of 2000 and 2008. And now investors are being warned that the Crash of 2016 will be even worse, with new losses of 50%. In short, the market really is bad news.

But still, here we are again, panicking: Fearing that 2016 will repeat 1929, fearing that Wall Street and Main Street, tens of millions of Americans, plus the Fed, the SEC, Washington politicians in both parties will refuse to prepare for the Crash of 2016. Will deny hearing the warnings … of the Crash of 2016, one that promises in the end to become bigger and badder and far more dangerous than 2008, 1999 and 1929 combined. Listen closely, the countdown to the Crash of 2016 has started.

The walk-in cash trade was quiet today and so were the phones – very quiet as represented by our Unscientific Activity Scale. I would not be too concerned here – in the coin business there are many levels of “quiet” unknown to the public – there’s “scary quiet” (really) and my favorite “run for your life quiet” (I just made that up but needed something after “scary”).

The GoldDealer.com Unscientific Activity Scale is a “ 2” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 5) (Tuesday – 5) (Wednesday – 5) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash.

In addition to our freshly ground coffee we offer complimentary cold bottled water, cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy question.

Thanks for reading – we appreciate your business. Enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.