Commentary for Friday, Feb 13, 2015 – Gold closed up $6.40 at $1226.50 in quiet trading as the 100 Day Moving Average holds ($1216.00) but strong safe haven buying fades. The technical picture while not horrible is not encouraging.

The reasons for this settling in price have been talked to death. Decline in tension within the Euro Zone, possible compromise in the Greek debt fallout, and the Ukraine ceasefire is holding. Today’s numbers out of Europe are also not terrible considering their problems.

But the gold market lacks any buzz going into our long weekend. By the way we will be closed this Monday for President’s Day – the post office, banks and Comex will also be closed. If you are curious as to what is happening in Europe on Monday our site uses a live European price feed so the bullion products will show changes while the US markets are closed.

While I don’t sound too excited the gold market is holding its own. Last week it was down $55.00 and this week even with a strong dollar we saw a modest $7.00 decline so the curve is flattening out a bit.

Dollar strength on the long term has capped gold prices but Dollar Index on the short term has turned somewhat neutral – as of this writing we are trading at 94.10 and the range has been 93.90 to 94.19 so off the highs and relatively flat. Crude oil tells a similar story on the 5 day chart supporting gold in that prices have been in an upward slope moving from $49.00 to $53.00 a barrel – we are now trading close to that recent high.

Silver was up $0.50 at $17.27 with lots of new interest in 100 oz silver bars. Notice the jumpy nature of silver lately? Fading to below $17.00 and then quickly moving above $17.00 – we have seen that pattern a number of times. It may provide at least anecdotal evidence that physical demand will support prices in the $16.00 range so a bottom is in and downside is limited.

Platinum closed up $7.00 at $1210.00 and palladium moved higher by $21.00 at $794.00. Frankly with platinum trading at $16.00 under the price of gold I’m was surprised we have not seen more action. The amount of live tradable platinum bullion products is thin but manageable. Given gold looks flat and Europe stable with a boat load of fiat currency on the way, I would think platinum industrial usage alone would prompt trades of gold bullion for platinum bullion.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 7 believe gold will be higher next week – 4 think gold will be lower and 2 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 40 people thought the price of gold would increase next week – 32 believe the price of gold will decrease next week and 28 think prices will remain the same.

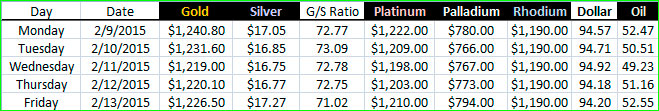

Precious Metal Closes & Dollar Strength – Feb 9 – 13

Now this is interesting from Reuters – “In other industry news, physical gold sales in Europe jumped in January as concerns over the euro zone’s outlook drove consumers to load up on bullion. Gold transferred between accounts held by bullion clearers rose to an average volume of 20.3 million ounces a day last month, up 4.4 percent from December’s figure, the London Bullion Market Association said on Thursday.”

Granted this data is from January and last month the picture for safe-haven gold buying was much different – more contentious and slightly dangerous. Of course the Reuters post makes sense because of gold’s big drive to the upside beginning the 2015 year.

So if European gold demand drove prices higher by $100.00, a C-note which was given up when things cooled down over Greece and EU problems you may want to ask if this three card Monte game has changed. Rhetorical question really – nothing has changed and in fact the coming ECB bond buying program and the Greek delayed bailout repayment will once again haunt their newly minted Keynesian monetary policies.

You could make the case that similar US monetary expansion has not been gold’s white knight. And you would be right for now, but a segregated European business machine is a horse of a different color. So my short term bet is that we have not heard the last of this European knee jerk reaction at protecting their savings. Expect such reality to reappear when the cards are reshuffled.

Could the Euro-Zone stage a big comeback? Sure – the German stock market (DAX) is actually doing fairly well according to numbers released this morning. Spain showed zero growth but the other EU countries are showing improvement – that is why gold’s safe haven aspect is moving to the back burner.

But the underlying problem with this scenario is that long term debt is financed with cheap money. Change either variable and the bike becomes unstable. There is no solution to this because the social state cannot quit providing goodies to an aging population. Japan is the poster child of this conundrum – low birth rate – decreasing real earners – more reliance on inefficient government oversight. Even the United States must deal with the problem within the Social Security system.

Finally let me throw in a comment from Chuck Butler (Everbank/Michael Snyder) – “Over the past decade, there has been only one other time when the value of the U.S. dollar has increased by so much in such a short period of time. That was in mid-2008 – just before the greatest financial crash since the Great Depression. A surging U.S. dollar also greatly contributed to the Latin American debt crisis of the early 1980s and the Asian financial crisis of 1997. Today, the globe is more interconnected than ever. Most global trade is conducted in U.S. dollars, and much of the borrowing done by emerging markets all over the planet is denominated in U.S. dollars. When the U.S. dollar goes up dramatically, this can put a tremendous amount of financial stress on economies all around the world. It also has the potential to greatly threaten the stability of the 65 trillion dollars in derivatives that are directly tied to the value of the U.S. dollar. The global financial system is more vulnerable to currency movements than ever before, and history tells us that when the U.S. dollar soars the global economy tends to experience a contraction. So the fact that the U.S. dollar has been skyrocketing lately is a very, very bad sign.”

So what to expect on the shorter term? Volatility in the price of gold will decrease because the fear factor is moving lower. For now things have quieted down but everyone still has their finger on the gold trigger because we have not entered into the end-game in this new monetary experiment.

If you are looking for lower prices consider the 60 day gold chart: we have moved from $1300.00 downward to around $1220.00 but there is solid long term support going back to December in the $1180.00 to $1200.00 range so we could see a great deal of bouncing around this level as the short money attempts to break down current support lines.

The walk-in cash trade was on the quiet side today and so were the phones.

The GoldDealer.com Unscientific Activity Scale is a ” 4” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 4) (Wednesday – 3) (Thursday – 3). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash.

In addition to our freshly ground coffee we offer complimentary cold bottled water, cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits. Like us on Facebook and follow us on Twitter @CNI_golddealer.

Thanks for reading – we appreciate your business. Enjoy your long weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.