Commentary for Wednesday, Dec 3, 2014 (www.golddealer.com) – Gold closed up $9.50 at $1208.50 even though the Dollar Index surged higher which means we might be seeing some bargain hunting above $1200.00 as hard as that might be to believe.

Again watching the Dollar Index we began the trading day around 88.58 – reaching a high of 89.01 and finally settling about 88.75 – this is the highest point on the index since 2010. So today’s rise in the price of gold above the now vaulted $1200.00 mark is surprising and lends credence to the new notion that gold may have put in a short term bottom.

And WTI Crude oil was even a bit weaker today settling at $66.88. This too should have dampened the push to higher ground for gold but did not so while I would not get out the party hats – all in all this was not a bad trading day for gold.

Worth considering – the stronger the dollar becomes the less likely that the Federal Reserve will soon raise interest rates. And a stronger dollar could choke off the still fledgling US economic recovery perhaps opening up the possibility of resumed quantitative easing.

This is a light news day – India has changed a few gold rules (more on that later) and the ADP Employment Numbers came in under expectations. Actually everyone is wondering what Mario Draghi and the European Union will do later this week – to QE or not to QE is the question? Of course they will inflate but it is amazing how much leverage Draghi has developed just by talking about buying bonds. They actually have not done much as yet but just the repeated “story” is enough for now.

Silver was again quiet – off $0.05 at $16.35. I am beginning to think the $16.00 number holds sway with the physical crowd. Across the counter action is average to slow in this current range but any dips into the high $15.00 range creates a great deal of action.

Platinum closed up $10.00 at $1227.00 and palladium was down $7.00 at $796.00.

This is our usual ETF Wednesday information – Gold Exchange Traded Funds: Total as of 11-25-14 was 51,659,180. That number this week (12-02-14) was 51,916,022 ounces so over the last week we dropped 40,158 ounces of gold.

It might also be interesting to note that in 2013 the record high for all gold ETF’s was 85,112,855 ounces. In 2014 the record high was 56,456,599 and another record low was set last month – 51,859,216 ounces.

All Silver Exchange Traded Funds: Total as of 11-25-14 was 639,362,349. That number this week (12-02-14) was 638,929,251 ounces so over the last week we dropped 433,098 ounces of silver.

All Platinum Exchange Traded Funds: Total as of 11-25-14 was 2,684,522 ounces. That number this week (12-02-14) was 2,668,217 ounces so over the last week we dropped 16,305 ounces of platinum.

All Palladium Exchange Traded Funds: Total as of 11-25-14 was 3,005,380 ounces. That number this week (12-02-14) was 3,048,584 ounces so over the last week we gained 43,204 ounces of palladium.

These comments by Neils Christensen (Kitco) – Analysts See Short-Term Boost For Gold, Euro Thursday With No New ECB QE – “Gold and the euro could see short-term rallies Thursday as the European Central Bank holds off introducing new quantitative easing measures following its monetary policy meeting, some analysts say.

The gold market has been extremely volatile, with major prices swings seen in the last few days and analysts are expecting the ECB meeting will add to the mix as expectations have been growing that central bank president Mario Draghi will announce an expanded asset-backed purchase program and buy government bonds.

As recently as Nov. 21, Draghi said the ECB is willing to increase its efforts to stimulate the Eurozone’s struggling economy.

However, some analysts said it is still too early for the central bank to expand its purchase program and the lack of new information could help drive the euro higher, on initial short covering, and in turn boost gold prices.

Bill Baruch, chief market strategist at iiTrader, said that the weaker-euro-stronger-U.S.-dollar trade appears to be losing some momentum as the U.S. Dollar Index, which is heavily weighted against the euro, runs into strong resistance around the 89 level.

He added that Draghi likes to talk down the euro during his monthly press conference, following the monetary policy meeting, but that could prove difficult on Thursday if he doesn’t announce new concrete initiatives.

If Draghi doesn’t announce that the ECB will start to purchase government bonds, Baruch said that he would expect traders to cover some of their short positions in the euro, which means buying the single currency and selling U.S. dollars.

However, even if gold does get a boost on Thursday, it might not have enough power to break through initial resistance at around the $1,221-an-ounce level, he said.

“After the big swings in the last few days, I think we will find ourselves in a consolidation pattern this month ahead of nonfarm payrolls and the Federal Reserve (Open Market Committee) meeting,” he said. “There is a risk that the euro moves higher but gains will be limited.”

Analysts from Capital Economics said that although central bank officials have openly discussed the possibilities of buying government bonds, they are not expecting a new purchase announcement until the 2015.

Peter Buchanan, senior economist at CIBC agreed, saying that he is expecting the ECB to hold off on announcing new initiatives, at least until they determine the impact of lower oil prices on the economy. Although weaker crude prices are deflationary they are also a major tax break for consumers, he said.

“Central banks are still grappling with lower oil prices and I don’t think they will make any decisions until they know the full impact on the economy,” he said.

Buchanan added another factor against the ECB expanding its asset-purchase program is continued resistance from other central banks, most notably the German central bank.

Although a euro rally on Thursday could provide some short-term momentum for gold prices, Buchanan also explained that overall it is bearish for the yellow metal as the ECB will not loosen its monetary policy, pushing down inflation expectations, a significant driver of the gold market.

Expectations for further QE initiatives are a close call as European economic growth remains weak and inflation expectations hover near historical lows; for some market participants, there is a feeling of urgency for the central bank to act aggressively.

Currency analysts from BNP Paribas said that they are expecting the ECB to announce that it will buy sovereign debt at Thursday’s meeting, which would be negative for the euro and negative for gold prices. They said the euro looks “under-positioned” ahead of the monetary policy meeting.

“We think comments from President Draghi and Vice President Constancio are likely to prove more instructive—both made supportive remarks on the merits of sovereign QE and seem unlikely to have delivered this message without being confident in their ability to deliver new announcements this week,” they said.”

The above commentary from Christensen outlines nicely why the price of gold especially on the short term remains a game of shadows. I believe most traders will admit the technical picture longer term is negative for gold but a look at the 10 year graph will show that gold’s rising bottoms line may have broken down around $1200.00. That’s why there remains a great deal of uncertainty. To be honest I am not particularly excited over gold’s recent bounce back from the rejection of the Swiss Referendum – but the market curiously does not feel heavy to me – only cautious.

I think that if the price of gold once again tested the $1150.00 range the short trade would be empowered and the already bearish technical picture would gain solid momentum. But considering we are showing downward resistance in the current trading range you might be looking at a short term bottom.

The rest of the trading world might be waiting to see what Europe does and the economic results of oil trending lower. Also keep in mind we are heading into the holidays – while this may seem benign it could turn out to be a trading “cooler”. We might have to wait until 2015 to see gold’s pricing pattern become more defined – one way or the other.

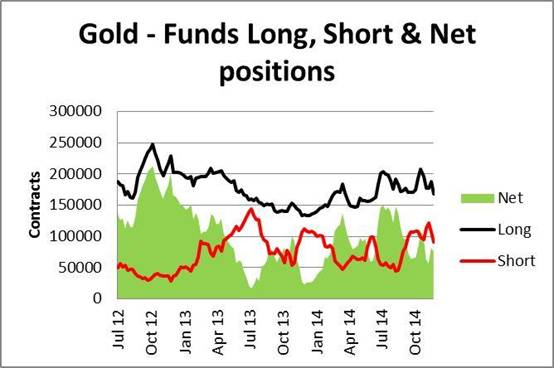

We talk a lot about the “short trade” in gold having a big influence on its paper price. This graph from Fast Tracks will help illustrate what is happening so we will publish this information from time to time.

Gold comment: As of November 25, the NLFP dropped 5,215 contracts on busy two-way activity that saw gross longs cut 20,561 contracts and gross shorts cut 15,346 contracts. So long liquidation and short-covering have kept prices fairly rangebound.

This from Bloomberg (Dhiraj Singh) Surprise End to India Gold Controls Boosts Wedding Demand – For Indian gold buyers looking for bargains ahead of the main wedding season, the scrapping of curbs on imports last week couldn’t have come at a better time.

“I’m very happy that I’m able to get more gold within my budget,” said Sunita Jain, 55, a housewife whose son is getting married this month. “Prices have fallen and may fall even more,” she said while checking out jewelry stores in Mumbai’s Zaveri Bazaar.

The Reserve Bank of India on Nov. 28 unexpectedly removed rules requiring importers to sell 20 percent of their shipments to jewelers for re-export. The end of the regulation, which limited buying since its introduction in July last year, will reduce smuggling and return domestic demand to normal levels of about 800 metric tons to 900 tons annually, the Indian Bullion and Jewellers Association Ltd. estimates.

“This was the trigger to get wedding demand going,” said Kumar Jain, owner of jewelry retailer U.T. Zaveri in Mumbai. “The shops are crowded now. This move will remove the monopoly enjoyed by the bigger traders and allow more supplies to smaller jewelers.”

An average of about 5 million weddings every year fuel demand for gold in India, according to Prithviraj Kothari, managing director of Riddhisiddhi Bullions Ltd. in Mumbai. He estimates average purchases for a wedding at about 200 grams. The main marriage season runs from November through May. Bullion is bought for weddings as part of the bridal trousseau and gifts. Demand also climbs during the festival season that runs from late August to October.

Deficit, Rupee – Imports by India, which accounted for 25 percent of global demand in 2013, plunged after the government imposed curbs to narrow a record current-account deficit and stop a slump in the rupee. The government increased import taxes three times in 2013 to 10 percent and introduced the 80:20 rule.

After the controls cut imports and narrowed the deficit to about $32.4 billion in the fiscal year ended March 31, 2014, from a record $87.8 billion a year earlier, the government in May eased the curbs, allowing more traders to ship in the metal.

Imports in October jumped to about 150 tons, the highest in the year started April 1, people with knowledge of the matter said on Nov. 13. Overseas purchases in the April 1 to Nov. 15 period jumped to 710 tons, a finance ministry official who asked not to be identified in line with departmental policy said Nov. 28. India imported about 640 tons of gold in the year that ended March 31, the people said.

Surprised Markets – The decision to ease restrictions “surprised” markets that had anticipated the possibility of tighter rules being introduced, UBS Group AG analysts Edel Tully and Joni Teves wrote in a note on Nov. 28.

“The removal of the main constraint on the supply chain should be positive for gold as it frees up the inflow of the metal into India, where appetite has remained quite healthy,” Tully and Teves said. Declining prices may further act as catalyst for demand, said Haresh Soni, Chairman of the All India Gems & Jewellery Trade Association.

“It’s the wedding season and consumers were waiting for right prices,” said Soni, whose association represents about 300,000 jewelry retailers and bullion dealers. “Because of the abolition of 80:20 scheme domestic rates may come down a little bit because premium will come down.”

Annual Losses – Shares of jewelry retailers rallied in Mumbai today. Titan Co. Ltd. (TTAN) rose 5.2 percent to 390.20 rupees, the most at close since Aug. 21, and Gitanjali Gems Ltd. climbed by the daily limit of 20 percent to 60.15 rupees. Shares of Rajesh Exports Ltd. gained 3.9 percent to 172.80 rupees, while Tribhovandas Bhimji Zaveri Ltd. (TBZL) advanced 19 percent to 179.60 rupees.

Gold for immediate delivery in London headed for a second year of declines after it lost its appeal as a hedge against inflation as oil prices slumped to a five-year low. The price fell as much as 2.1 percent to $1,142.88 an ounce today, the lowest in three weeks, after Swiss voters rejected a measure requiring the central bank to hold at least 20 percent of assets in gold. It traded at $1,173.83 at 4:42 p.m. in Mumbai.

Bullion in London has dropped 2.3 percent in 2014 after slumping 28 percent last year, the most since 1981. Futures on the Multi Commodity Exchange of India have fallen 9.3 percent this year to 25,768 rupees ($415) per 10 grams.

‘No Threat’ – A recovery in gold imports won’t pose a threat to the current-account deficit or the rupee as commodity prices are declining, according to Shilan Shah, an economist at London-based Capital Economics Ltd.

“Even if India’s gold imports now pick up, the threat of the current-account deficit ballooning to previous levels is slim,” Shah wrote in a Nov. 28 note.

The move to scrap the rule reflects policy makers’ growing confidence in the external sector outlook, Sonal Varma and Aman Mohunta, economists at Nomura Holdings Inc., wrote in a research report on Nov. 29. Gold imports will rise by $8 billion annually because of the abolition of the 80:20 rule, although this will be offset by lower oil costs as every $10 fall in crude prices lowers the oil import bill by about $9 billion, they said.

Easier import rules will also reduce the incentives for smuggling the metal, Soni of the jewelers’ federation said. Illegal inflows into India may be about 200 tons this year, the World Gold Council said Nov. 13.

The council on Nov. 28 reiterated its prediction that demand for the year will be from 850 to 950 tons. The sharp increase in imports in recent months was not triggered by changes in demand estimates and was more likely a result of expectations for additional curbs, P.R. Somasundaram, the managing director for India, said in an e-mailed statement.

“The government has understood that the Indian mentality is that when you restrict something, we tend to buy more and more,” said Kothari, who is also the vice president of the Indian Bullion and Jewellers Association.

The walk-in cash trade and national phones were uninspiring today. The action was not exactly dead but it’s not a good sign when the staff begins talking about lunch at 10:00 in the morning.

The GoldDealer.com Unscientific Activity Scale is a “3” for Wednesday. The CNI Activity Scale takes into consideration volume and the hedge book: (Thursday and Friday – closed) (Monday – 6) (Tuesday – 6). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”. Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

Email confirmation using a PDF File when buying or selling is functional. It also includes the various forms of payment and includes bank wire instructions. And you can now see your actual invoice or purchase order on your computer screen.

When you buy or sell please check to see if we have your current email on file and that your computer will accept our email (no spam).

About shipping information – when buying or selling your rep will walk you through your current mailing information. Thanks for keeping us up to date if you have moved.

Our four flat screens downstairs with live independent pricing (BullionDesk.com) are a big hit with the cash trade. Live pricing moves all the buy/sell product prices on a real time basis. Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. When buying from us remember if you exceed $10,000 in cash (the real green kind) a Federal Form is necessary.

In addition to our freshly ground organic coffee offered visitors throughout the day we have added cold bottled water, cokes and Snapple. We have also added fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer.

Our holiday schedule this year – Christmas (Closed Thursday the 25th and Friday the 26th) – New Year’s (Closed Jan 1st and 2nd).

A gentle reminder – each year during this holiday season the packages delivered to all 50 states slow down because Santa has control of the air traffic.

We appreciate your business – thanks for reading and enjoy your evening.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.