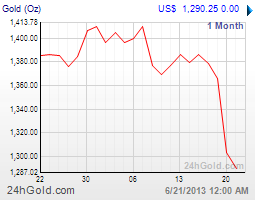

Commentary for Friday, June 21, 2013 – Gold closed up $5.70 at $1291.60 which looks like a dead cat bounce (and a feeble one at that) considering yesterday’s route where gold was down a whopping $96.00 on the week. Still when you are ready to settle for anything any strength sounds like good news and I will take it going into an uncertain weekend especially because the dollar was 0.7% stronger.

As far as Bernanke’s comments yesterday no one was happy including Wall Street as even the rumor of higher interests is a cooler. The Chairman is between a rock and hard place as far as possible easing so the solution is not clear and the result (good or bad) is just as foggy. I still think there is only a 20% chance of tapering before year end because the real unemployment number is rigged but we will have to wait and see. Let’s hope that this recovery is really underway and will continue for the sake of the American worker but a jobless recovery is worthless and will not prompt the Fed to taper.

Silver’s response to yesterday’s party was also subdued with an unconvincing bounce of $0.13 at $19.95. So we are down $2.00 on the week and trading at the lowest levels seen since September of 2010 but with more than a 50% retracement on the books you should see a considerable physical demand even though the rank and file are confused.

Platinum was up $6.00 at $1371.00 and palladium was up $10.00 at $674.00.

(Kitco News) – The majority of participants taking part in the Kitco News weekly gold survey look for the metal to extend lower next week. This week’s survey had smaller-than-normal participation, with 19 of 36 regular respondents taking part. Of those, 11 see prices down, while four see prices up and four look for sideways consolidation. Market participants include bullion dealers, investment banks, futures traders and technical-chart analysts. Some look for the market to continue to factor in scaled-back quantitative easing in the U.S., following Federal Reserve commentary this week, which would continue to pressure gold. “Gold should continue its downtrend in anticipation of the Fed’s early tapering of QE this fall, along with inflation data being revised lower,” said Phillip Streible, senior commodities broker with RJO Futures. “It seems the market is convinced that QE will completely end by mid next year.” Ralph Preston, principal with Heritage West Financial, also suspects that the market could remain on the defensive with a weak technical-chart picture. Prices extended lower Thursday after a classic bear flag formation from mid-April, he said. “It’s more market psychology and deleveraging,” he said. Some looking for an uptick in gold, however, suggest the market has over-reacted as it factored in future scaling back of monetary stimulus. “After all, this has been discussed all year, without action, and we are only talking about a scaling back of the additional stimulus (the $85 billion a month in bond buying) that started this year,” said Adrian Day, president of Adrian Day Asset Management. “But this is the problem with monetary stimulus; it’s like a drug where ever-increasing injections are required just to stay flat. The Fed has painted itself—and the U.S. and global economy—into a corner and can’t get out of it neatly. Given the global monetary accommodation that continues, I suspect we’ll see a bounce next week.” Last week, 65% of survey participants were bullish, but gold fell this week instead following a Federal Open Market Committee meeting and press conference by Chairman Ben Bernanke. Since May 13, 2011 when the survey started, participants have been right 44% of the time, as of June 7. Until Nov. 23, survey participants had more than a 50% accuracy rate, suggesting that since then there has been a change in the trend for gold.

Finally let me paraphrase a great email from a reader: One way of looking at the bloodbath in the precious metals today is to realize that I got a raise! If I invest a certain portion of my US$ income in precious metals every month, I now get more ounces of precious metals every month. If you believe that gold and silver are truly money and everything else is paper or electrons, it translates into a raise.”

Both walk in and phone trade was again swamped with virtually no big sellers so the public is aware, even though prices have been generally lower that this latest shake-out might represent real value in the physical world.

Because of the suddenness of these changes the CNI phone banks have at times been overloaded and we apologize for the delay. Thanks for reading and the nice comments…enjoy your evening. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.golddealer.com).