Commentary for Thursday, Feb 27, 2014 – Gold closed up $3.60 at $1331.60 in trading pushed by the Yellen comments assuring everyone that quantitative easing will remain in place and that the Fed remains “vigilant”.

Tension in the Ukraine provides some safe-haven buying and this morning the newly formed government has asked the IMF (International Monetary Fund) for monetary assistance. The problem with IMF intervention is that in many cases it sets up a scenario of handouts which last for decades. So are they really helping the world’s poor and developing nations?

Today was a quiet rebound from yesterday’s $14.00 decline in gold. The dollar which has been on a slight advance of late was unchanged today on news of a drop of 1% in January durable goods orders. Also a rise of 14,000 new claims for unemployment felt like a non-event. Yellen’s testimony today was virtually unchanged from her comments a few weeks ago so we can expect low rates for an extended period of time. She seemed convinced that recent US economic slowdown was weather related but did give herself some wiggle room and both her and other FOMC members see no reason to change the current course of diminished quantitative easing. Chuck Schumer had no trouble asking her if the economy continues to slow would the Fed modify their tapering program and she was adept as Bernanke in keeping her answers on point but vague enough to instill Wall Street confidence. The big seller in gold today was the American Gold Buffalo 1 oz.

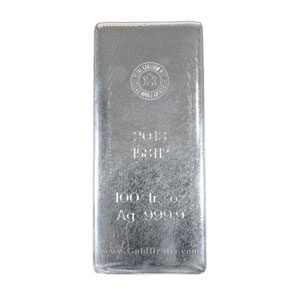

Silver closed up $0.06 at $21.31 and we continue to see virtually no large physical sellers. From Debbie Carlson (Kitco): Silver Stays Under $22/Oz to Dismay of Investors – UBS – Silver has found breaking through $22 an ounce difficult and this is likely frustrating investors, says UBS. After this year’s rally, silver pulled back on Wednesday after trying to take out that level all last week. “Silver might currently be experiencing some form of indigestion: the 110 (million-ounce) increase in net-long positions in the last two weeks may have been too much, too fast for the market to take,” UBS says. However, they note the rise in net-long positioning was on mostly short covering, with only some new longs added. “Given silver’s volatility and the overall difficulty in trading this white metal, it is not difficult to see why recent longs would be easily tempted to book profits. These positions would have been initiated from early February through to early last week and silver has gained nearly 14% during this time,” the firm says. Today the RCM 100 oz Silver Bar was popular with investors.

Platinum closed up $25.00 at $1453.00 and palladium also closed higher up $11.00 at $742.00. The strike has been in place for more than a month now and there is also talk about increased imports of platinum jewelry into India because limits are still in place for gold. The Australian Platinum Platypus 1 oz is still outselling all our other 1 oz platinum coins.

The walk-in cash trade was average today despite the first round of rain. And the phones were busy all day so our Activity Number (3) is disappointing.

The GoldDealer.com Activity Scale is a “3” for Thursday. The CNI Activity Scale takes into consideration volume and the hedge book: (last Friday – 5) (last Monday – 5) (last Tuesday – 4) (last Wednesday – 3) (Thursday – 3). Our scale (1 through 10) is a reliable way to understand volume numbers.

On the new GoldDealer.com site: Comex closing prices are posted on the home page and individual product landing pages. Live pricing on the site moves all bullion products up or down during the day. The change number included next to the live pricing uses yesterday’s Comex closing prices as a reference. So if the change number is green and shows up $3.00 this is in reference to yesterday’s close. You now don’t have to visit several sites to find the Comex close relative to live trading numbers which are independently verified.

We reworked the All Bullion Products link on the home page. It now includes our Bid (blue) and Ask (green) prices. When you hover over it with your cursor the text is highlighted.

Premium quotes vary with product and look like this – “spot plus $15.00” or “spot plus $50.00” and bullion products list them under the live prices on their respective landing pages. This makes product comparison easy and GoldDealer.com is the only precious metal site on the net with this transparency. For example click on the link American Gold Eagle and under Our Live Buy Price and Our Live Sell Price you will see: our Buy Premium Spot + $15.00 and our Sell Premium Spot + $50.00 – Easy.

Live Chat is doing well and new customers like setting up their own encrypted accounts. Improvements will continue through the 1st quarter of 2014. Let us know what you want. We recommend upgrading old browsers to Google Chrome (free/secure) especially as our site becomes more advanced.

Sign up for our daily Gold Newsletter on the Gold Newsletter page if you are so inclined and remember this is now live for you too so why not sound off? Reader insight is interesting and varied.

Email confirmation when you are buying or selling is functional. A PDF file will be added which will create a picture invoice identical to the store invoice. This invoice will include information like wiring instructions.

The four flat screens downstairs with live independent pricing (The Bullion Desk) is a big hit with the cash trade. This live stream moves all the buy/sell prices on each product so the cash buying public can see the markets move on a real time basis. Our site uses the same pricing model so no more guessing.

Our best price guarantee (buying or selling) remains famous so call Kenny at 1-800-225-7531. And for more than 30 years we have guaranteed your complete satisfaction. Like us on Facebook and follow us on Twitter @CNI_golddealer. Thanks for reading and enjoy your evening.