Commentary for Friday, March 20, 2015 – Gold closed up $15.70 on the Comex today at $1184.80.

Today’s pop to the upside in gold is all about the US dollar. The Dollar Index closed yesterday at 99.07 and the high to low range today is 99.12 to 97.93. We are now trading at 98.22 – about mid-range today and off from yesterday’s close by a substantial 0.85. A weaker dollar suggests higher prices in gold but today’s modest move to the upside is supported by the FOMC news Wednesday that interest rates would not rise on the shorter term.

So traders are more willing to take long positions on the short term knowing that the interest rate hammer is not going to be dropped anytime soon. But keep in mind that Janet Yellen can decide before, during or after any FOMC meeting that it is time to raise rates. This coupled with the amazing strength in the dollar will hobble gold on the shorter term.

On the more positive side there are two factors which support higher gold prices on the short term and both hold the short paper trade in check. The first is our ridiculously overvalued stock market – I am not a big stock guy but I do own some and PE ratios of 30 or 40 or even 50 to 1 are common. Retired Dallas Fed’s Richard Fisher offered such warnings this morning on CNBC. A large drop in the price of stocks could send gold soaring.

Second, GoldCore this morning claims that a Greek exit from the European Union could push gold to the $2000.00 mark. I don’t know about that but any serious crack in the EU will put gold back in the spotlight.

Will this happen? Probably not because Drahgi is serious about the ECB commitment to quantitative easing – but there are big problems in Europe and Greece might just be the canary.

So is this latest move by the Federal Reserve a game changer for gold? If you look at the 60 day price chart we have moved from $1300.00 steadily downward to the $1250.00 range and bounced off this lower price support a number of times before the Fed pronouncements. Since Yellen has shared her thoughts there is a renewed vigor in pricing moving against this downward trend.

But it’s too soon to count the bears out – they are still in charge. Whether this latest interest in gold turns out to be a game changer remains to be seen. I would not get too excited short term until gold once again moves above $1300.00 – in the meantime there may be a great deal of huffing and puffing going on.

Silver was up a big $0.77 at $16.86 so congratulations if you bought the most recent dip. Keep in mind however that silver at today’s close is still considered cheap by the physical market. It is not considered cheap by paper traders – there are a few large players who were looking for considerably cheaper prices before the Federal Reserve announcement.

Platinum was up $21.00 at $1141.00 and palladium was up $13.00 at $778.00.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 11 believe gold will be higher next week – 1 thinks gold will be lower and 1 believes it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 48 people thought the price of gold would increase next week – 33 believe the price of gold will decrease next week and 19 think prices will remain the same.

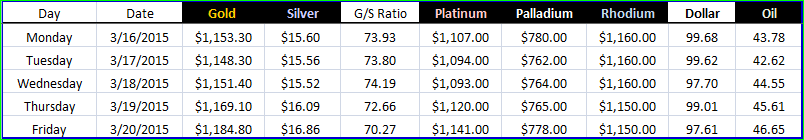

Precious Metal Closes & Dollar Strength – March 16 – 20

This Kitco post makes a few important points. Namely that gold’s future may not as dim as technical charts seem to indicate. Yes the bears are in charge and the short money will be pushing for lower prices especially as the dollar trends higher. But there are a number of good things which are also in play relative to gold.

This from Kitco – U.S. Fed Loses Patience; What’s Next For Gold? – With investors and traders continuing to digest the recent Federal Open Market Committee (FOMC) meeting, one U.K-based research firm remains positive on gold prices believing that inevitably higher U.S. interest rates will have only a limited impact on the global market.

Julian Jessop, head of commodity research at Capital Economics, said that U.S. interest rates are only one piece to gold’s puzzle and higher U.S. interest rates aren’t necessarily negative for prices in the long-term.

“In particular, more than 40% of gold demand last year came from Indian and Chinese consumers – for whom the nuances of U.S. monetary policy are practically irrelevant,” he said in a report published Wednesday. “We expect demand from these key markets to pick up again this year as local headwinds fade, regardless of what happens at the Fed.”

Jessop admitted that the anticipation of rate hikes have been negative for gold as it boosted the U.S. dollar and U.S. treasury yields. He also expects that the initial reaction to the first rate hike will be negative for gold.

“It is not unreasonable to link rising U.S. interest rates with falling gold prices, other things being equal. The level of interest rates represents the opportunity cost of holding gold,” he said. “The improvements in economic and financial conditions which justify the normalization of monetary policy are also likely to reduce the demand for safe havens.”

But he also noted that the lift off in U.S. interest rates should also be taken into historical context. Jessop said that the peak in fed funds rate is expected to hit 3.50% by 2017, “way below the peaks even in the last two tightening cycles.”

The Fed itself also sees a lower peak in this rate cycle. In their recent economic projections, the Fed’s “dot plot” – an informal view of where the FOMC members see the fed funds rate by the end of the year – shows that the majority see interest rates between 0.5% and 0.75% by the end of 2015. Long-term interest rates are expected to top out between 3.50% and 3.75%.

Following Wednesday’s central bank meeting, economists at Capital Economics still see the Fed pulling the trigger on higher rates at the June meeting as “it would take something dramatic at this stage to delay the first rate hike beyond mid-year.”

However, they have downgraded the pace of rates cuts this year, expecting to see the fed funds rate between 0.75% and 1.00% by year-end, down from their previous forecast of 1.00% to 1.25%. Jessop also warned that Fed tightening could lead to investor portfolio rebalancing, which could also be a positive for the gold market.

“Indeed, if Fed tightening takes the edge off the rallies in global equity markets, gold might even benefit from switching back out of stocks,” he said.

He reiterated the firm’s call that they are expecting gold prices to end the year at $1,400 an ounce, “despite the risk of some further near-term weakness.

The walk-in cash trade was moderately busy and the phones were either hot or cold.

The GoldDealer.com Unscientific Activity Scale is a “ 7” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (last Friday – 7) (Monday – 5) (Tuesday – 7) (Wednesday – 5) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy question.

Thanks for reading – we appreciate your business. Enjoy your weekend and remember to set your clocks ahead one hour this Sat night – Daylight Savings Time begins Sunday at 2 AM.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.