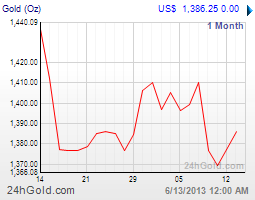

Commentary for Thursday, June 13, 2013 – Gold gave up yesterday’s gains closing down $14.20 at $1377.60 but still holding the key $1360.00 level. News of higher retail sales continues to encourage the paper markets but the real numbers don’t have much weight. News from India that gold imports have fallen by as much as 75% since the imposition of a new gold tax June 6th does not sound encouraging.

Silver made new post high lows today down $0.21 at $21.59 and this number is at its lowest point in 32 months.

Platinum was down $35.00 to $1448.00 and palladium down $26.00 to $729.00 on South Africa news that a strike threatened last week is postponed. You might also want to include the notion that prices are weak because Europe is now in danger of slipping back into recession.

So where is gold going and is there more grief for the bulls? If you consider what gold has done this past decade the recent sell-off is similar to what we saw in June of 2008 or about a 20% downside move from $1000.00 to $800.00. The recent weakness moving from $1900.00 to $1350.00 or about 30% has been more severe but the times are much different. Most do not feel like they must run for their financial lives but the intuitive understand that governments must be watched and treasure protected.

Still in the June of 2008 sell-off the mood was also somber and technically the charts also belonged to the bears. At that time no commentator would have predicted what came to pass, a doubling in the price of gold in three years. Today the charts still belong to the bears and even if you are a gold bullion enthusiast much of the background noise has subsided. The stock market is looking better, the banks are looking better; the public mood for a protective shield against the government printing press is not as extreme. Today talk of a similar doubling in the price of gold ($2800.00) would be met with skepticism.

I receive emails from perma-bulls claiming my position does not do CNI customers any service. That is actually a quote from a recent reader who claimed I must be a newbie to this market and he cited a number of excellent sources which make a solid case for higher prices. Being commercially and personally involved in owning gold since the 1970’s I have seen a number of severe corrections which were counterintuitive. None of these changed my personal belief in gold bullion but there were years in which that belief was tested. This latest sell-off is another example in which lower gold prices really don’t make much sense but there you have it. I quote an old coin dealer saying “it is what it is”.

The question today is how does the investor put this market to work in favor of owning gold for the longer term? I think an undying belief that gold must move higher against a technical picture which looks like it wants to test recent lows does no one justice. And banging on about higher gold prices because of crazy government practices gets tiring and starts to sound like just so much promotional trash.

It would be an extreme case to believe gold is finished longer term but prudent to take action which suggests this correction is still unwinding and pressured lower by a change in Fed policy. I have stated many times the Federal Reserve has already printed enough fiat money to push gold to new record highs if the public feared the destruction of the US dollar. We really love the American Gold Buffalo This week.

But clearly this is not the current case so until further dollar weakness makes the case for higher gold prices and I think a bit of caution is warranted. If I am wrong you have lost nothing because a surge in gold prices would once again signal trouble in River City and there would be plenty of time to get on broad. If I am right you will save a few bucks and in the process feel better about your investment decisions.

So for the time being watching and waiting for further opportunity makes sense. There are many nationalities which will not be patient because gold is a permanent part of their investment thinking but this is not the case with American buyers. They want in when prices are moving higher and out when they are moving lower. There are exceptions but really only the committed will follow the Asian lead.

I raise African violets; they are beautiful and remind me of my childhood. And when the markets get real wonky they are especially nice to enjoy. So embrace these lower prices and put them to work by keeping the bigger picture in mind.

If you are looking for my guess in the price of gold anything less than $1400.00 is pretty cheap but the current market is vulnerable technically and could retest recent sell-off levels ($1350.00) but no guarantees here as the world remains messy. Both Europe and the US talk a great game about capping possible damage from prolonged monetary easing but both are still in deep water.

Finally famous gold guru James Turk talked with King World News and claimed A Summer Gold and Silver Explosion That Will Shock The World: reader comments are solicited. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.GoldDealer.com).