Commentary for Friday, June 14, 2013 – Gold closed up $9.70 at $1387.30 which might be a reaction to President Obama’s plan to arm Syrian rebels in reaction to the use of outlawed gas against civilians. This Middle East conflict is a complete humanity disaster which promises to grow as the innocent pay the price of poor leadership. And if things get out of hand the world will also pay so I’m surprised that oil is not quickly moving higher and this might be an indication of just how stuck the world is within a global recovery.

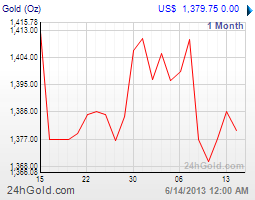

Gold was up $4.00 this week and down $9.00 last week and up $6.00 the week before so we are definitely rangy and this in spite of rumors which claim heavy speculative short positions in gold. Under normal trading even a rumor of heavy shorting is enough to move the prudent to the sidelines but this is just another example of how conflicted this market has become. Upon some short reflection I guess you could say that this is also what you would expect when the government gets involved in real business…a confused outcome.

Next week Chairmen Bernanke speaks and traders will be listening carefully so market direction will once again be dictated by the Fed. To continue monetary easing, modify easing, or stop easing in a preemptive strike against damage already done but not felt as yet. I would not want to make that call but my guess is that Bernanke will stand pat but assure all that if easing becomes a problem the committee will quickly change their collective mind. Gold will then move mildly higher but remain within its current range and so paper traders will continue to look for weakness or strength and place their bets accordingly.

If the Syrian problem gets out of hand look for oil to skyrocket, derailing any real worldwide recovery in the making and gold will head dramatically higher.

Silver was up $0.36 at $21.95 still technically weak but hanging in there at the lower end of its trading range. I look for more of the same but will let you know if I hear any buzz.

Platinum was up $1.00 at $1449.00 and palladium was also up $1.00 at $730.00. HSBC talked about platinum today lowering their 2013 average price forecast by 4% to $1715.00. They also expect to see a shortage of 800,000 ounces of platinum this year resulting from supply problems in South Africa and if this sounds counterintuitive it really reflects their belief that world commerce will remain in the drink and so quantitative easing will remain the soup de jour and support gold prices.

In the Kitco News Gold Survey, out of 36 participants, 23 responded this week. Of those 23 participants, 15 see prices up, while six see prices down and two see prices moving sideways or are neutral. Market participants include bullion dealers, investment banks, futures traders, money managers and technical-chart analysts. Last week 41% of survey participants were bullish. As of noon EDT Friday, prices on the week were up about $3. If that holds, then most survey participants forecasted correctly. Since May 13, 2011 when the survey started, participants have been right 44% of the time, as of May 31. Until Nov. 23, survey participants had more than a 50% accuracy rate, suggesting that since then there has been a change in the trend for gold. Those who see higher prices said they expect gold to bounce slightly after holding the bottom end of the established range, which is roughly from $1,375 to $1,425 an ounce. “We are likely to see a continuation of the very uneven recovery from the mid-May test (so far successful) of the April lows, as opposing forces battle each other; monetary conditions remain very accommodative, while there are concerns about a future withdrawal as the economy improves. In my view, the Federal Open Market Committee has continued its bias towards ease,” said Adrian Day chairman and chief executive officer, Adrian Day Asset Management, who added that other central banks continue with their easing bias. Sterling Smith, futures specialist, commodity research, Citibank Institutional Client Group, said next week’s FOMC meeting is a wild card. “I am of the opinion we will see little change in their stance…as they look like they are caught in ‘the push me pull me’ situation. The market (should) be getting over the idea that QE is ending or ZIRP (zero interest rate policy) is going away. I guess this force me to be a little bullish but sentiment is rather weak so I am not very bullish,” he said. Those who see weaker prices said they expect gold to test the downside because there’s little reason for gold to rise. Richard Baker, editor, the Eureka Miner Report, forecast prices to dip to $1,365 an ounce. “Until the current relation of gold and U.S. equities changes, I continue to be bearish on the short-term prospects of the yellow metal. The longer-term prospects remain positive,” he said. Bill Goldman of 3GF Corp is one of the participants who is neutral on prices for next week. “The gold price is holding up even as ETF (exchange-traded fund) outflow trickles out and Indian demand has slowed under the (Indian) taxes and restrictions. Offsetting this is that Chinese demand is steady and emerging central banks continue to nibble. Neutral (price action) for a week is likely before a move higher will start in two weeks,” he said.

I was watching the Conspirator last night, the film centered on the assignation of President Lincoln and the subsequent defense of a co-conspirator Mary Surrott. In the opening scenes her defense lawyer is given advice by a Southern politician “experience counts for nothing when they are making up the rules as they go”.

This advice should be a great reminder as to the financial danger posed by the current experiment we now see as central banks use unrestrained monetary easing. And the unknown possible outcome is the biggest single reason to own physical bullion today. Governments are simply making up the rules as they go and our future financial condition really does hang in the balance. If they get it right past experience will prove an asset but if they get it wrong many will go broke believing in the new promises.

This advice from a reader is welcomed and should be a core belief if you like gold: “I don’t understand why a long term bull would want the price of gold to go up. The lower it is the less you pay for it while you accumulate. An impatient investor should not invest in gold anyway. In the last 12 years I have seen gold go up more than 400%. It takes patience to benefit from long term trends in any asset.”

And we also received this nice thought from a number of readers regarding yesterday’s gold newsletter: “Kenny, thanks for today’s missive. A thoughtful, considered opinion on the gold market is rare and welcome, in a internet world full of hyper-ventilating promoters talking their own books. Take a bow!”

Finally if you have visited our Home Page and got a default position of “Under Construction” please refresh your page and the original content will reappear. This is a server problem we are working on and nothing more…but within 2 months you will see a completely revised on-line site with live pricing which will also be streaming within the CNI Building on large flat-screen monitors.

These changes are being tested as we speak and when complete we will be the only LA dealer with such in house capability. I have seen some of the testing models and they are completely transparent using an independent live pricing stream which drives our buy and sell prices. Thanks for reading and enjoy your weekend. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.GoldDealer.com).