Commentary for Friday, June 12, 2015 – Gold closed down a sleepy $1.10 today at $1178.80 on the Comex in what can only be described as a continued choppy market. It traded on both sides of unchanged last night in Hong Kong through London and finally into domestic trading. On the week gold was higher by $11.80 so you can see trading has been very quiet and ranges very close.

There was some firmness in gold today but I think only because the Dollar Index sold off from daily highs around 95.70 moving down to 94.86 at the time of this writing. This selloff is probably the result of less expectation that the Federal Reserve will do anything with interest rates next week as the FOMC gets its usual public attention.

I think it’s still not clear as to what exactly the Fed has in mind but the improving US economy continues and the Federal Reserve may be running out of reasons not to push interest rates higher – certainly before year end but perhaps sooner.

The price of gold is still stuck – trading between $1170.00 and $1190.00. A tight range considering that Europe is getting its act together and US stocks continue solid to perhaps even higher. As long as the stock market continues to receive star power and the dollar remains firm around 95.00 I think the price of gold will struggle.

That does not mean there is no business across the physical counter – as I pointed out yesterday the real gold bullion trade is alive and well – they are just cheap buyers.

So on the short-term, if the Fed does not raise rates look for more of the same – tight trading ranges with a slight bias to the downside. If you want to be critical you could point out that gold has breached the $1180.00 support line which goes back to April.

And just as gold broke to the upside in May moving above $1200.00 it could easily break to the downside, again testing $1140.00. But all things considered this lower range has held up for a couple of years – and the world central banks are still in trouble and still printing fiat currency.

The only real possibility of a break to the upside on the short-term is a breakdown in the debt talks with Greece and a failure to pay or default on her obligations. I find any Greek exit from the EU to be a pipe dream. For good or bad it seems the IMF and the ECB are stuck with Greece and her mountain of debt. But like I said – any default would push gold considerably higher.

Silver closed down $0.13 at $15.82. The silver bullion market across the counter is alive and well regarding Mexican Silver LIbertads, Canadian Silver Maple Leaf Monster Boxes and finally Philly Silver Monster Boxes. Why? Actually silver is cheap but the reason the public visits the store and walks out with the Monster Box is because they are all trading for less than $10,000. The Silver Eagle Monster Box as of this writing is $9180.00 – meaning you can pay cash – walk away with the box and be under the $10,000.00 reporting requirement. This cash dynamic always works in favor of Monster Boxes when the price of silver dips.

Also worth remembering is the rather large rise in silver holdings of the exchange traded funds this week. I of course prefer personal physical ownership but none the less these funds hold sway – they are an important informational source as to how the public is thinking.

Keep in mind that silver fundamentals favor the investor. The last time I checked it costs about $24.00 to mine silver out of the ground and silver bullion is real money in many countries. There are no large stockpiles and we use a great deal of silver in industrial applications. Its unit cost is also an important aspect because its small – meaning the potential pool of investors who can afford to play is exceptionally large.

Platinum closed down $8.00 at $1097.00 and palladium closed down $4.00 at $738.00.

This from Kitco – A Pop in Chinese Equity Bubble Could Push Gold Higher – Natixis – One French bank has described the Chinese equity market as “impending doom” which could be good for the gold market in the long-term.

Gold demand has suffered in Asia during the last 12 months as Chinese investors have jumped into equity markets but their funds could start to shift back as equities enter bubble territory, Bernard Dahdah, precious metals analyst at Natixis, said in a research note Thursday.

According to the World Gold Council, gold demand in China during the first quarter of 2015 was 272.9 tonnes, down 7% from the first quarter of 2014, which saw gold demand of 293.8 tonnes. However, the council does note that first quarter demand was still well above the five-year average of 231.9 tonnes.

Dahdah noted that the yellow metal has not been able to compete this year as equities as rallied close to 150% in the last 12 months.

“As with all bubbles, while it keeps inflating investors may be happy to remain invested. If a few IPOs were to fail spectacularly, or one or two larger companies allowed to default, a sharp fall in Chinese equity valuations would not surprise anyone. Gold could then become a more interesting alternative for Chinese investors,” he said in the report.

While Chinese equities are an extreme example, they are not the only ones. Dahdah noted that global gold demand has suffered as investors put more of their faith in stocks markets.

A common theme in these financial markets has been a reduction in fear sentiment. Investors are more confident that the aftershocks as a result of the financial risks have abated.

“The dollar’s growing strength over the past year has firmly subdued fears of a U.S. currency collapse and hence the role of gold as a safe haven has become significantly less attractive, even for risk – averse investors,” he said. “As investor confidence in global financial stability increases, so does risk appetite. As a result, equity markets across the developed world are currently trading close to all-time highs.”

Although western markets don’t have bubbles as big as China, Dahdah said there is still a risk of a sizable correction as the easy money from the Federal Reserve’s quantitative easing measures dry up.

“In such a scenario gold prices may be able to break with their recent correlations, benefiting from an environment in which rising bond yields accompany an equity market crash,” he said.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 5 believe gold will be higher next week – 5 think gold will be lower and 3 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 37 people thought the price of gold would increase next week – 43 believe the price of gold will decrease next week and 20 think prices will remain the same.

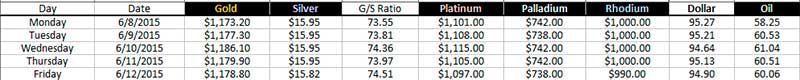

Precious Metal Closes & Dollar Strength – June 8 – Jun 12

This from The Economic Times – NEW DELHI: “India’s industrial production output grew more than expected in April, reaching a two-month high, and retail inflation edged up in May, easing concern over an economy facing the worst drought since 2009.

Output at factories, mines and utilities grew at an annual rate of 4.1 per cent in April, the fastest pace since February. That was higher than March’s 2.5 per cent growth and the 1.6 per cent economists forecast in a Reuters poll.

Consumer inflation in May rose to 5.01 per cent from 4.87 per cent in the previous month on higher energy costs. Economists polled by Reuters had expected retail prices to rise 5 per cent year-on-year.

The output data comes days after GDP data showed India outpaced China by growing 7.5 per cent in the March quarter. It supports the government’s view that the world’s fastest-growing major economy is gathering steam.”

The above excerpt is part of my inflation scenario – the people of India really need no incentive when it comes to the gold bullion market. But look at their creeping inflation number – 5% in May! And there is no publicity on this number here in the states. With a 5% inflation rate what would you buy if you held rupees?

The walk in trade was active all day – even crowded – all cash buyers. The phones were moderate.

The GoldDealer.com Unscientific Activity Scale is a “ 4” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 4) (Wednesday – 6) (Thursday – 7). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”. Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

Thanks for letting us know when you move or change your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your weekend.

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.