Commentary for Friday, March 6, 2015 – Gold moved significantly lower today off $31.80 on the Comex to close at $1164.10 and gold was down as much as $4.00 in the after-market so fears of lower prices earlier in the week were justified.

The smashing jobs report was the culprit for gold fans – as data released today showed 295,000 new jobs created versus an expected 240,000 number – and the official unemployment fell to 5.5% from 5.7% so the government and the Keynesian monetary creators are crowing.

And of course because the jobs number is strong it augers in favor of a Fed interest rate hike perhaps by this summer – although opinions are mixed here – one thing however is sure: the Federal Reserve has repeatedly suggested it will “signal” a rate hike in advance. So if Fed Chair Yellen takes out the word “patience” in their next data release you better take a seat.

Continued dollar strength hammers the price of gold. As of this writing the Dollar Index is trading at 97.62 – it put in a daily low at 96.30 and a daily high at 97.73 – yesterday’s close was 96.34! The amazing jobs number contributes to this rising tide and EU quantitative easing insures a lower euro relative to the dollar – so it’s the perfect storm.

While everyone is talking about dollar strength I got a kick out of Kira Brecht’s (Kitco) observation about cycles. “From July 2001 through March 2008, the U.S. dollar index collapsed from over 120.00 to below 71.00, or a drop of over 41%. Ouch, for those holding their wealth and savings in U.S. dollars that is a substantial loss of purchasing power in the global marketplace.”

There is no question that a stronger dollar creates havoc with the price of gold but it pays to keep your powder dry. Today we have the double whammy of strong dollar strength coupled with the coming interest rate hike now all by confirmed because of the double strong job’s number.

But I fall into the group which believes there is Catch 22 here and the dip in gold prices might not be as large as most believe.

Let’s wait and see what physical demand shows up and consider that we are already in an oversold position relative to gold. The Chinese numbers today look like a slowdown was in the cards – normally a negative for gold. But the Bank of China claimed it would stimulate – the common answer these days and so lower interest rates may encourage the physical market.

I’m afraid we are in a House of Mirrors when it comes to absolutes for the physical gold market: Weak technical picture – yes – discouraging news relative to higher interest rates – yes – an absolutely unbeatable dollar – yes – no inflation rate – yes.

But let’s not get too carried away with the mighty dollar and other factors. There are some (CNBC) insiders who believe the recovery could be short lived and the recession cycle closer than most believe. This short “run-way” could easily lead to a reverse in dollar fortunes.

And the physical demand from both China and India is underestimated by the West. So let’s be patient and see if this test to the downside in gold is real or just another bump in a market which remains oversold. There is nothing like lower prices to spark business.

This from Christopher Rugaber (Associated Press) – U.S. Adds Robust 295,000 Jobs; Jobless Rate Falls to 5.5% – WASHINGTON – U.S. employers extended a healthy streak of hiring in February by adding 295,000 jobs, the 12th straight monthly gain above 200,000. It was the latest sign that the U.S. economy is further strengthening and outpacing other major economies around the world.

The U.S. unemployment rate fell to 5.5 percent from 5.7 percent, the government said Friday. But the rate declined mainly because some people out of work stopped looking for jobs and were no longer counted as unemployed.

February’s robust job gain wasn’t enough to boost wages by much. The average hourly wage rose just 3 cents to $24.78 an hour. Average hourly pay has now risen just 2 percent over the past 12 months, barely ahead of inflation.

Still, over that time, 3.3 million more Americans have gotten jobs. More jobs and lower gas prices have led many consumers to step up spending. That’s boosting the economy, offsetting sluggish economies overseas and giving employers the confidence to hire.

The jobs figures provide “more evidence that the labor market is recovering rapidly, with employment growth more than strong enough to keep the unemployment rate trending down,” said Jim O’Sullivan, chief U.S. economist at High Frequency Economics. Falling unemployment “makes more acceleration in wages increasingly likely.”

At 5.5 percent, the unemployment rate has now reached the top of the range the Federal Reserve has said is consistent with a healthy economy. That could make it more likely that the Fed will act soon to raise interest rates from record lows as early as June.

“This is quite a symbolic change that increases the pressure on the Fed to hike rates in June,” said Paul Dales, an economist at Capital Economics said.

Indeed, after the jobs report was released Friday morning, investors sold ultra-safe U.S. Treasurys, a sign that many anticipate a Fed rate hike. The yield on the 10-year Treasury note rose to 2.18 percent from 2.11 percent before the report was issued.

The U.S. job market and economy are easily outshining those of other major nations. Though Europe and Japan are showing signs of growing more than last year, their economies remain feeble. The euro currency union’s unemployment rate has started to fall, but at 11.2 percent it remains nearly twice the U.S. level.

The U.S. economy expanded at a breakneck annual pace of 4.8 percent in last year’s spring and summer, only to slow to a tepid 2.2 percent rate in the final three months of 2014. Many economists estimate that growth is picking up slightly in the current quarter to an annual rate of 2.5 percent to nearly 3 percent.

Still, economists remain bullish about hiring despite the slowdown in growth. The fourth quarter’s slowdown occurred largely because companies reduced their stockpiles of goods, which translated into lower factory output.

But companies focus more on consumer demand in making hiring decisions, and demand was strong in the October-December quarter. Americans stepped up their spending by the most in four years. And though consumers are saving much of the cash they have from cheaper gas, spending in January still rose at a decent pace after adjusting for lower prices.

Mark Zandi, chief economist at Moody’s Analytics, expects the economy to grow 3 percent this year, which would be first time it’s reached that level in a decade. That’s fast enough to support hiring of about 250,000 a month, he said.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 6 believe gold will be higher next week – 4 think gold will be lower and 1 believes it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 54 people thought the price of gold would increase next week – 49 believe the price of gold will decrease next week and 1 thinks prices will remain the same.

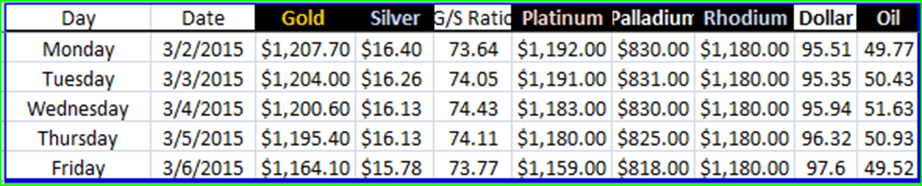

Precious Metal Closes & Dollar Strength – March 2 – 6

The walk-in cash trade was classic – mobbed – all buyers – everyone was waiting on lower prices. But check this out – at around Noon California time the action cooled considerably – an hour later we were mobbed again. The phones were the same – the American public loves gold and silver bullion too – they just want cheaper prices, like everyone else.

This Monday will help with sorting out the short-term case for the across the counter bullion market. If gold heads south everything will cool off – if there is a significant bounce in prices traders will be encouraged and the public will act – interesting times for sure especially if you are a real fan of gold and silver bullion.

The GoldDealer.com Unscientific Activity Scale is a “ 5” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 4) (Tuesday – 5) (Wednesday – 4) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash.

In addition to our freshly ground coffee we offer complimentary cold bottled water, cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy question.

Thanks for reading – we appreciate your business. Enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.