Commentary for Friday, Feb 20, 2015 ( www.golddealer.com) – Gold closed down $2.70 on the Comex today at $1204.40 and while it feels like there is not much happening gold has actually decreased around $94.00 this past month. Still complacency seems to rule even though there are major currency forces at work.

The Greek state is deeply in the red and banks are feeling the pressure – commentary indicates that 25 million euros have left her banking system since the beginning of the year. Is it panic time? Probably not but the heat in the kitchen is rising.

The geopolitical environment is also heating up. There are serious problems with the Russian/Ukraine situation – especially with ceasefire problems. The Middle East remains a mess and could easily get worse but for now gold has ignored both situations.

The Chinese still seem very interested in more gold – to date this year 374 tonnes have been brought in from the Shanghai Exchange to China.

Silver closed down $0.11 at $16.26.

Platinum closed down $3.00 at $1172.00 and palladium was off $7.00 at $779.00. As we have noted before the price of platinum is now about $32.00 less than the price of gold. So relatively platinum is very inexpensive and investors are buying more platinum bullion. As this price discrepancy continues available platinum bullion products become more difficult to find. The Canadians still are not producing the popular platinum Canadian Maple Leaf. My point is that most large dealers are now short platinum bullion products.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 4 believe gold will be higher next week – 6 think gold will be lower and 2 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 41 people thought the price of gold would increase next week – 41 believe the price of gold will decrease next week and 18 think prices will remain the same.

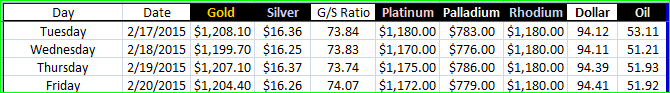

Precious Metal Closes & Dollar Strength – Feb 17 – 20 (Closed Monday)

Still gold on the short term will put you to sleep – the trading range overnight (Hong Kong and London) is tight – slightly under $1205.00 and slightly over $1210.00. The wider view is worth thinking about so consider gold’s 30 day chart. Prices have been generally lower moving from $1300.00 to bouncing around $1200.00 so the bears hold all the cards.

The reasons we have not continued to test the downside is twofold. The first being the continued confusion over Greece and the possible fall out within the European Union. And even this is turning into a well-orchestrated Katz and Jammer Kids. CNBC claims Greece will run out of money in March unless it secures more lending. The Germans accuse Greece of Trojan Horse tactics designed to produce further concessions – Ouzo anyone?

And now this according to AP BRUSSELS – “Greece and its European creditors reached Friday a deal over the country’s request to extend its bailout that would keep the country from falling out of the euro bloc.

An official close to discussions, who spoke only on condition of anonymity because he wasn’t authorized to comment publicly, says a deal was reached between the two sides at a meeting of finance ministers in Brussels.

The official said that, as part of the agreement, Greece could “present a first list of reform measures by Monday” for the country’s debt inspectors to assess.

European creditors have insisted that any extension to loans should be accompanied by a commitment to some budget measures and reforms.”

The second is the possible outcome as the European Central Bank puts its quantitative easing program into action. Because this result is also unknown gold continues to hold the important $1200.00 line.

In the longer term however we must throw the Federal Reserve interest rate factor into the pot. There is some reasonable commentary which claims they will raise interest rates this summer – I disagree but let’s assume the job’s number continues to improve and the Fed wants to test the water. They have to do something sooner or later because money has been essentially free since 2008 and the governors rightly fear real financial damage could be the payback. At any rate when they raise interest rates gold will flounder but the degree to the downside will not be as dramatic as some propose. Why? Because the gold market is already figuring this move into the current trading model – by the time the news is common place prices will reflect little change.

This from Reuters – Gold imports to top consumer India are set to jump in coming months after the Reserve Bank of India (RBI) eased gold import curbs, ahead of an expected cut in import duty in next week’s budget.

The Reserve Bank of India said on Wednesday banks would again be allowed to import gold on a “consignment basis”, under which they act as intermediaries and don’t pay for the stock until a buyer has been found, which is usually quickly.

Trading houses will be allowed to bring in gold with no conditions attached.

Gold flows into the country have slowed despite the removal in November of the so-called 80-20 rule that required importing agencies to re-export a fifth of total imports, as importers and customs officials waited for more clarity.

“These clarifications were pending for a long time and should boost sentiment. Gold imports may increase to 75-90 tonnes in coming months as against about 40 tonnes in recent months,” said Prithviraj Kothari, executive director of the India Bullion & Jewellers’ Association.

Imports had dropped despite the reversal of the rule as the industry was taken aback by the sudden change in the central bank’s position and banks remained wary, fearing customs officials would hold up incoming shipments.

“Some imports had been stuck at the airport, but not huge quantities, as customs officials were awaiting clarification from the RBI. They will be cleared now,” said Sudheesh Nambiath, an analyst at precious metals consultancy GFMS, owned by Thomson Reuters.

Nambiath said imports could average 80 tonnes a month, boosted by the RBI move and expectations of a duty cut.

The central bank acted just days ahead of the government budget, due on Feb. 28.

Expectations are high that Narendra Modi’s government will reduce the import duty on gold from a record 10 percent, set in 2013 by the previous government as part of efforts to cut the current account deficit.

“We view the clarification by the RBI on the 80-20 rule relaxation as positive for the bullion market as it is a step in the right direction towards the possibility of a relaxation in gold import duty,” HSBC analyst James Steel said in a note.

“Indian gold demand would undoubtedly benefit if the government decided to cut gold import tariffs in response to the big drop in its current account deficit,” he said.

The deficit has narrowed recently due to the drop in gold imports plus a sharp slide in oil prices.

Gold is a popular gift at weddings in India and is also bought for auspicious occasions.

Demand should therefore pick up from March for the wedding season, which continues until July, while Akshya Tritiya, a major festival associated with gold-buying, falls in April.

This from a reader – “How are miner ETFs linked to physical trading prices of gold and silver, in today’s manipulated paper markets? If China/Russia tie their currencies to gold, won’t that help miners? I read diverging views in the money press. Thanks.”

Because I am in the physical gold business I have little to do with gold or silver mining stocks but they are an interesting proposition to many investors. Admittedly gold mining stocks have suffered disproportionately to gold bullion itself. In other words this time around gold has actually held up better even though challenged. Mining stocks have been hurt badly but here is where I get off the train both for physical gold and mining stocks: I never have bought the trade argument which claims price manipulation. I appreciate it is popular but I think as demand goes down either for real gold or mining stocks the price follows. It is simple and sometimes brutal and let me add this footnote: it does the gold trade no good to keep beating the drum about “price manipulation” – this has been investigated and always ends up on a slippery slope.

So what to do? Bury this argument – it’s old and tired. There are plenty of good reasons to buy physical gold or mining stocks which make perfect financial sense. Real gold bullion provides “foolproof” insurance against currency collapse and runaway inflation. I’m not suggesting either will happen but I like the physical gold market for the same reason I buy health insurance.

As far as miners are concerned they have over reacted to negative gold news – they virtually collapsed in price – not because of paper manipulation (IMHO) but because of over speculation. I am not a big miner fan but a small bet here to the upside in a few larger gold mining operations might prove rewarding just because I’m a contrarian investor.

Finally if China and Russia tie their currencies to gold it certainly would help the physical gold market and miners. Any positive news helps all of the gold industry – and it needs help at this point. Eventually this possible union could change dollar hegemony but these changes would take decades. Russia would love to challenge the dollar but even with legitimate steps toward bringing the Kremlin into the 21 Century it is still closer to the American gangster era than a modern financial state. What they really need is a few more generations of Yankee capitalism under the hood.

The Chinese are already working toward a gold backed currency – they continue to buy gold from Western nations who, for some unexplainable reason are ready sellers. But they are in no hurry to challenge the dollar – why should they? They hold vast stores of our currency because the world can’t get enough of their manufactured goods. By the time everyone wakes up to the recently reformed Chinese world view today’s gold price will seem like the bargain.

The walk-in cash trade was at times mobbed today. The phones were also busy and the action mix was fairly even although cheaper silver prices are now encouraging across the counter silver bullion sales.

The GoldDealer.com Unscientific Activity Scale is a “ 4” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Closed Monday) (last Tuesday – 3) (last Wednesday – 3) (last Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash.

In addition to our freshly ground coffee we offer complimentary cold bottled water, cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits.

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now interested in our Facebook page and he is a self-proclaimed expert on conspiracy theory and vintage clothing – he would be happy to answer even the most ridiculous conspiracy question.

Thanks for reading – we appreciate your business. Enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.