Commentary for Thursday, July 2, 2015 – Gold closed down $6.00 today on the Comex at $1163.00. So we remain weaker into the long weekend but the losses were pared by the June Jobs Report – it did not meet expectations, but did not miss by much. This helped weaken the dollar and kept gold from moving even lower.

There is still a lot of attention focused on the Greek default which has turned into a political football as well – support Prime Minister Alexis Tsipras or accept the IMF plan? Who knows where this is going but one thing is certain – the public is disappointed that the default did not push the precious metals higher in price.

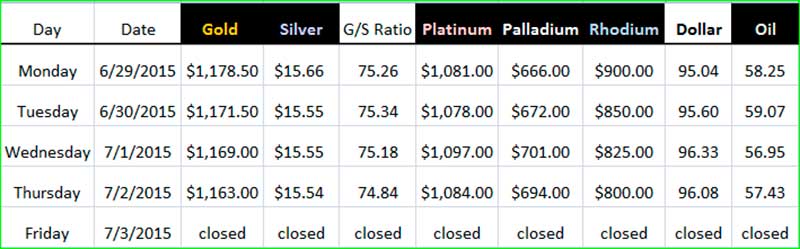

This continues to create the sense of a soft precious metals market but surprisingly the price of gold and silver is actually pretty firm considering the negative press – gold down $20.00 since the beginning of 2015 and silver off only $0.02 during the same time period. The PGM metals have not fared as well – platinum down $120.00, palladium down $104.00 and rhodium down $445.00 (this is the lowest level since 2004).

Don’t expect much action today most traders have already left for the long 4 th of July weekend. The 4 th of July falls on a Saturday – so the CNI Building will be closed Friday July 3 rd for our Independence Day. Also note that the trading markets, banks and post office will also be closed Friday – July 3 rd. Wishing you all a happy and safe 4 th of July.

Silver closed down $0.01 at $15.54 and the physical trade in silver bullion today was subdued.

This from Joe O’Donnell (Coin World) – U.S. Mint’s June American Eagle silver bullion coin sales more than double May’s – “Sales through the first half of 2015 are down compared to the first half of 2014 – Though it was a strong June for U.S. Mint American Eagle silver bullion sales, total sales over the first six months of 2015 are down from 2014. Sales of the U.S. Mint’s American Eagle silver bullion coins totaled 4,840,000 ounces in June 2015, up from 2,023,500 ounces in May, and up compared to the 2,692,000 ounces sold in June 2014, according to Mint figures posted online July 1. Even after the strong June sales, total Mint silver bullion sales through the first six months of 2015 are down over the same period last year. To date, 21,786,000 ounces of silver bullion coins have been sold in 2015. During the first six months of 2014, 24,128,500 ounces were sold.”

The above post by Coin World is amazing but will probably go unnoticed. I figured something was happening with $1000 face 90% bags because premiums were moving higher – now look at the American Silver Eagle 1 oz sales for June. I appreciate silver prices are cheaper but there may be something else going on here – we are supposed to be in the typical summer doldrums for the coins business – which is generally true but not for silver bullion products. And look at the total sales volume of Silver Eagles – 21,786,000 coins. As I have pointed out we buy virtually nothing back relative to what we sell even when prices move lower. This small public selling trend has been in place for years so these Monster Boxes are going into very strong hands.

Platinum traded down $3.00 at $1084.00 and palladium was off $7.00 at $694.00.

The jobs report sort of disappointed the trading floor and so the dollar was weakened today which supported gold somewhat but remember the Dollar Index is still trading above 96.00.

This from Sho Chandra (Bloomberg) – Labor Market Runs in Place; More Jobs, Participation Lowest Since 1977 – The U.S. labor market took one step forward and one back in June as job creation advanced while wages stagnated and the size of the labor force receded.

The addition of 223,000 jobs followed a 254,000 increase in the prior month that was less than previously estimated, a Labor Department report showed Thursday in Washington. The jobless rate fell to a seven-year low of 5.3 percent as people left the workforce.

The figures indicate the economy is improving slowly following a first-quarter slump rather than surging ahead as consumer spending strengthens. That will probably keep Federal Reserve policy makers on course to raise interest rates later this year with subsequent increases coming only gradually.

“The labor market is good, there’s just not any wage pressure,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, who correctly projected the drop in unemployment. “The disappointment is on wages and on the participation rate.”

Earnings at private employers held at $24.95 an hour in June on average and rose 2 percent over the past 12 months, matching the mean since the current expansion began six years ago. Wages had increased 2.3 percent in the year ended in May.

Seasonal adjustments, or a calendar bias, probably explained some of the downward pressure on the wage figures in June after artificially boosting them in May, according to economist Ted Wieseman of Morgan Stanley and Lou Crandall, chief economist at Wrightson ICAP LLC.”

This is our usual Thursday Chicago Mercantile Exchange report covering the last 5 trading days – so we are looking at the trading volume numbers for the “August” Gold contract: Thursday 6/25 (286,190) – Friday 6/26 (286,230) – Monday 6/29 (286,114) – Tuesday 6/30 (283,573) – Wednesday 7/01 (285,041). These numbers remain in the higher end of the range.

Our Patented Employee Survey– Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 8 believe gold will be higher next week – 3 think gold will be lower and zero believe it will be unchanged.

Our Patented Customer Survey– Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 55 people thought the price of gold would increase next week – 35 believe the price of gold will decrease next week and 10 think prices will remain the same.

Precious Metal Closes & Dollar Strength – June 29 – July 2 (July 3 rd US markets are closed)

For now gold looks like it’s married to the dollar. This makes sense given the problems in Europe, especially Greece, so let’s once again look at the Dollar Index. In the short-term this relationship is apparent so first consider the Dollar Index 5 Day Chart – since Monday we have moved from just above 94.50 to almost 96.50 – this is big and the reason gold has been weak.

Again ignore the so-called safe-haven buying which is suspect regardless of what dealers claim and Greece which is bankrupt and watch the Dollar Index.

Open up the index graph to a 3 month period and the picture is actually more encouraging for gold in the longer term. The trend line favors a weaker dollar market as we have moved off a high of 100.00 in April. Some might make a case that technically the Dollar Index may have broken to the upside in its most recent strength – moving above those descending tops but I think this is premature. Generally the Dollar Index looks like it wants to move lower and this will support higher gold prices but there is much more to this picture.

Refocus on the price of gold and consider the real physical market – it’s not Greece and it’s not safe-haven buying – all that is press related. The real clue here can be seen in a gold price chart going back to November of 2014. We have touched the $1140.00 mark in gold in November and bounced higher, revisited in March and bounced higher and are now repeating this move back to $1140.00 for a third time with the close today ($1163.00). In each of these three moves physical demand has increased dramatically across our counter as we approached $1140.00 and subsided just as quickly as the price of gold rebounded above $1200.00.

So what does all this mean? There are outside forces which influence gold’s direction and get all the press – but sometimes lead readers in the wrong direction. The real secret here might be the physical demand generated simply because this market is considered cheap by some as it approaches $1140.00.

And the conclusion is that as we approach this mark for the third time since last November the gold market is once again oversold.

If you are a gold pessimist or bear (there are plenty of both around these days) I don’t blame you. There is plenty of commentary claiming this $1140.00 mark will eventually give way pushed lower by higher interest rates.

Fair enough but I could make an alternative case using returning inflation – financial Black Swans – nuclear proliferation as some overlook a dangerous Iran – or even a much weaker Dollar Index, which by historical standards should be more like 80.00.

Granted it’s difficult to get excited about the price of gold in a sideways to lower market. But regardless of price I like gold bullion and don’t completely trust government function. So from a cost averaging standpoint it makes sense to add to core holdings as we approach $1140.00 – this is a practical consideration for those who like gold bullion and is supported by our actual sales across the counter.

Think about this – our sales to the ethnic trade (gold bullion bars) have recently increased dramatically. In fact this particular group within our larger bullion trade has purchased nearly half of last year’s total last month alone. So a quiet sector of the cash bullion market is buying furiously as general public interest wanes.

The walk in cash trade remains steady to busy, at times there was a short line at the back door. Phones were busy early in the day but slowed down considerably in the afternoon.

The GoldDealer.com Unscientific Activity Scale is a “ 7” for Thursday. The CNI Activity Scale takes into consideration volume and the hedge book: (last Friday – 6) (Monday – 6) (Tuesday – 6) (Wednesday – 7). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”. Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

Thanks for letting us know when you move or change your email.

Todays popular product was the Pamp Suisse Palladium Bar 1 oz.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your long weekend in celebration of America’s birthday!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.