Commentary for Friday, April 3, 2015 – All the precious metal markets were closed today because of the Easter celebration. Dealers which remain open will use the Thursday’s closing pricing when buying or selling.

Thursday’s closing prices gold ($1200.90) – silver ($16.68) – platinum $1154.00 – palladium ($746.00). Using yesterday’s close gold ended higher for the third week in a row adding $48.00 over that 3 week period so the short term technical picture remains positive.

And the dollar has lost some shine – it was traded today and saw a loss of 0.8% to 96.78 on the Dollar Index – this might indicate a stronger Monday open for gold after Easter. Jobs data released today was disappointing – 126k new jobs in March. This was the first time in over a year this number was less than 200k – also previous months were revised downward.

This too argues for continued virtually zero interest rates which is positive for gold. The expected time frame for a Federal Reserve push to the upside is between and April and the end of the year – but we will have wait and see – some are convinced there will no change in 2015. This is not my view – I think Yellen will throw something minor in the pot.

For the time being watch gold’s 100 Day Moving Average for clues ($1211.00). A break above this number might become a game changer.

Our Patented Employee Survey – Gold’s Direction Next Week?

Of course it’s not really patented but we do have some fun along the way. This is what the GoldDealer.com employees think – 7 believe gold will be higher next week – 2 think gold will be lower and 4 believe it will be unchanged.

Our Patented Customer Survey – Gold’s Direction Next Week?

Like the employees our customers were given three choices – up – down – unchanged. We limited the survey to a random sampling of 100 transactions – unscientific but worth considering because these people took action: 44 people thought the price of gold would increase next week – 38 believe the price of gold will decrease next week and 18 think prices will remain the same.

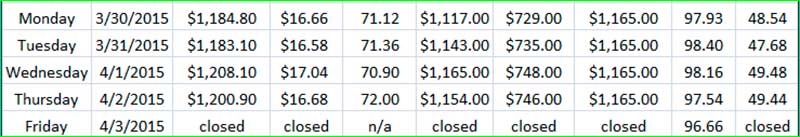

Precious Metal Closes & Dollar Strength – March 30th – April 3rd

This from Gwen Preston (Resource Maven / Kitco) – Gold’s Up, Gold’s Down – Where is Gold Going Now? – “Last week was a great one for gold. After an eight-week decline pulled the price back 11.5% to a closing low of $1,147.25 per oz. on Mar. 18th, gold jumped back to close above $1,200 on Mar. 26th. The question everyone is asking now: where will it go from here?

The long answer is the gold is looking good in the short term based on US dollar weakness, US economic softening in general, the phenomenon that a long list of government bonds are offering negative yields, and geopolitical events. The fact that commercial futures traders have winnowed their short positions to very low levels adds extra support to a bullish short-term outlook for the yellow metal. I’ll go through each of those factors in turn.

Greenbacks and Gold – The easiest way for gold to gain would be for the US dollar to stop rallying. That, in turn, depends on a raft of US economic factors as well as global geopolitical events. But there is good reason to believe the dollar’s ascent will take a real breather here, if for no other reason than its run to date:

As my friend Brien Lundin put it: No tree grows to the sky, no market makes this kind of rise without a correction. It looks like the correction has begun: the greenback slid more between Mar 15th and 25th than had for over a year. And there is real impetus driving the dollar down.

If America wants its economy to keep growing, a weaker dollar would help. The dollar’s strength is strangling exports, capping international profit margins, and generally making life hard for US companies.

The dollar has been climbing because (1) it is the safest of the main global currencies and (2) the US economy has been doing well, which supports the dollar in a world where other economies are struggling and governments injecting liquidity and providing interest rate support.

Point (1) is still true, though increasing worries of a US stock market crash are limiting the dollar’s safe haven status. Point (2) is more contentious every day: as Fed Chair Janet Yellen said, “Growth has moderated somewhat.”

The US Economy – The data are mixed. There are a record number of job openings but labor force participation remains low, largely because employers seem to be demanding skills that job seekers don’t have. As a consequence of this and other factors, wage growth has been very weak. With pay cheques stubbornly refusing to rise, workers are spending less, borrowing less money, and definitely investing less.

Or even taking their money out. Bank of America Merrill Lynch calculates US stocks have seen $44 billion in outflows year-to-date, the worst start to a year since 2009. Several factors are driving the move away from stocks, including investors applying caution to overly bullish portfolios, the stream of weaker-than-expected economic data, and the strong dollar.

The latter two forces – a slowing economy and a strong dollar – have investors worried about their investments’ bottom lines. As Bank of America put it, a “restoration of earnings-per-share confidence” is “needed for US inflows”. In other words, investors aren’t going to head back to the US markets in force without a solid showing of good Q1 earnings reports…which may not materialize.

The Commerce Department just released its revised estimates for the fourth quarter of 2014. The report said profits at US corporations posted their largest drop in four years in Q4. The Department also pegged corporate profit growth at 2.9%, slowing from 5.1% annual growth in the third quarter, and measurements of underlying demand in the economy showed weakness, with final sales of domestic product growing at just 2.3% versus 5% in the previous quarter.

Bonds Turned Bad – Amidst all that are bonds. The list of countries offering negative yield bonds (with maturities at least a year, but in many cases several years) currently stands at nine: Austria, Belgium, Denmark, Finland, France, Germany, Netherlands, Sweden, and Switzerland. Bonds from another six countries – Italy, Japan, Czech Republic, Hong Kong, Ireland, and Spain – are essentially offering zero yield. Late last week Rick Rule estimated the value of sovereign bonds offering negative yields at $4 trillion.

This is where gold gets some solid support. Until bond yields turned negative, investors continued in the ‘normal’ assumption that bonds offered a better return than gold. The rationale was twofold: the price of gold had been unstable and gold carries holding costs, whereas bonds offer reliable returns with no holding cost. Now those reliable returns are gone, replaced by negative yields – the new ‘holding cost’ of owning government debt. Bonds have become much less attractive than gold. Combine that with economic uncertainty and you have good reason to see gold hold or gain ground, especially once you add in geopolitics.

Proxy War in Yemen – Yes, gold’s rise last week was partly in response to the battle brewing in Yemen, which could turn into a full-on proxy war between the powers that be in the Middle East.

Yemen has been increasingly unstable since Shiite fighters from the north known as Houthis seized control of the capital, Sana, in January. It was the culmination of years of pressure. The Houthi waged a long insurgency against previous president Ali Abdullah Saleh, who agreed to step down in 2011. Now, four years later, the Houthi are working with security forces previously loyal to Mr Saleh to force his successor, Abdu Rabbu Mansour Hadi, first into hiding and then out of the country. The Houthi now control most of the Yemeni military, including its aircraft.

Civil war is terrible. Proxy wars are even worse. Unfortunately, Yemen increasingly resembles the latter. Saudi Arabia shares a long border with Yemen. The Saudi royal family support Yemen’s official government and oppose the Houthi, mainly because the Saudi royals are Sunni and Yemen’s government had been Sunni, even though the population of Yemen is actually split between Sunni and Shia. The Houthis, by contrast, are Shia.

Now place that into the bigger picture. Iran is Shia, which is why Iran is backing the Houthi financially and militarily. Saudi Arabia is now bombing Yemen in response to Houthi control and Iranian involvement. The Sunni-Shia divide has always been the main reason Saudi Arabia and Iran don’t get along and Yemen is the new proxy battleground. Citizens are, unfortunately, the main casualties. Supporting Saudi Arabia in this aggression: Egypt, United Arab Emirate, Kuwait, Bahrain, Qatar, Jordan, Sudan, Morocco, and now Pakistan.

Why all this support? Because Iran has been aggravating its neighbors lately: its backing of president Bashar al-Assad in Syria has been critical in extending the war there, its provocations have inflamed the conflicts in Iraq and Afghanistan, and its leaders are currently in talk with US president Obama over having arduous sanctions lifted in exchange for giving up its nuclear weapons, a feat Obama desperately wants to claim and Iran equally wants to trumpet.

Faced with Iran’s building clout, the players in the region are focusing on Yemen as a way to stifle Iranian influence. Adding adrenaline to the issue is that Yemen sits on the Bab al-Mandab strait, on of the world’s oil transit chokeholds. Bab al-Mandab links the Red Sea and the Gulf of Aden; 3.8 million barrels of oil pass through it every day on their way to world markets. That represents 7% of the world’s seaborne oil trade and 4% of global daily oil demand.

Cue international interest. If it threatens global oil supplies, a geopolitical event is bestowed with reams of significance. In response to Saudi bombing Yemen oil prices climbed (even though the world is awash in oil right now) and gold gained – safe haven status in full effect.

What are the Speculators Saying – Finally, what can we glean about gold from the speculators? The Commitment of Traders report tracks trading in gold futures – in other words, how the gold gamblers are betting.

The gamblers are divided into categories: large speculators, small speculators, and commercial traders. People like to obsess over the speculators, but it’s really the commercial traders who matter. These guys know the gold business inside and out. They are required to short the market to lock in some portion of their pricing, reducing risk. But they reduce their short positions when they see gold nearing a bottom – and commercial gold short positions are currently very low.

Both charts show the last year. On the upper chart the blue bars show cumulative bets by speculators that gold will go up (long bets minus short bets); the maroon bars show cumulative bets by commercial traders that gold will go down. The longer/more negative the maroon bars, the more commercial bets have been placed on a gold price slide.

Notice that the gold price basically mirrors the commercials positions chart: as the orange circles highlight, when commercial short positions are at their lowest, gold is generally at a bottom. Commercial short positions are pretty low right now. That bodes well for gold in the short term.

So – Gold lost a bit of ground today, which is no great surprise. This is a big week for economic data, so after gold’s gains last week traders are likely being cautious before the data starts to flow. As long as US data doesn’t include lots of surprises on the upside (which have been absent for some time), I would bet the dollar trades sideways, US markets slide slightly, and gold ends the week up. China and the Eurozone are also releasing economic data; strength from either would help gold and is possible from Europe, which has been surprising to upside regularly.

I see gold staging another surge before settling back for the summer and, after last week, I think that surge is now. Then again, I could be completely wrong.”

The walk-in cash trade was active today and the national phone trade was less than average.

The GoldDealer.com Unscientific Activity Scale is a “ 3” for Friday. The CNI Activity Scale takes into consideration volume and the hedge book: (Monday – 3) (Tuesday – 5) (Wednesday – 6) (Thursday – 4). The scale (1 through 10) is a reliable way to understand our volume numbers. The Activity Scale is weighted and is not necessarily real time – meaning we could be busy and see a low number – or be slow and see a high number. This is true because of the way our computer runs what we call the “book”.

Our “activity” is better understood from a wider point of view. If the numbers are generally increasing – it would indicate things are busier – decreasing numbers over a longer period would indicate volume is moving lower.

When buying or selling you will receive an email confirmation. This includes a PDF File to confirm your invoice or purchase order and includes forms of payment and bank wire instructions. When doing business please check to see if your current email has been entered into the new system and check to see if your computer will accept our email (no spam).

We always appreciate you keeping us up to date when moving or changing your email.

We believe our four flat screens downstairs with live independent pricing (BullionDesk.com) are unique in the United States. The walk-in cash trade can see in an instant the current prices of all bullion products and a daily graph illustrates the range of the markets on any given day.

Yes – you can visit the store with cash and walk away with your product. Or you can bring product to the store and walk away with cash. We will even wire funds into your account that same day for a small service fee ($25.00) if you are in a hurry.

In addition to our freshly ground coffee we offer complimentary cold bottled water, Cokes and Snapple. We also provide fresh fruit in a transparent attempt to disguise our regular junk food habits as we sneak down the block for the best donuts in the world (Randy’s).

Like us on Facebook and follow us on Twitter @CNI_golddealer. Sal is now in charge of our Facebook page and he is a self-proclaimed expert on gold conspiracy theory. He would be happy to respond to even the most ridiculous conspiracy assertion on our Facebook page so why not join the fun?

Thanks for reading – we appreciate your business and enjoy your weekend!

Disclaimer – The content in this newsletter and on the GoldDealer.com website is provided for informational purposes only and our employees are not registered financial advisers. The precious metals and rare coin market is random and highly volatile so it may not be suitable for some individuals. We suggest before deciding on a course of action that you talk with an independent financial professional. While due care has been exercised in development and dissemination of our web site, the Almost Famous Gold Newsletter, or other promotional material, there is no guarantee of correctness so this corporation and its employees shall be held harmless in all cases. GoldDealer.com (California Numismatic Investments, Inc.) and its employees do not render legal, tax, or investment advice.