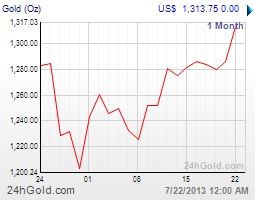

Commentary for Monday, July 22, 2013 – Gold moved dramatically higher first in the overnight market and then domestically up $43.10 and closing well above the much talked about $1300.00 level (for the first time in a month).

So this continued upward pressure on gold prices after revisiting the $1211.00 low 10 sessions ago. This time frame is important because a 10 session bounce higher without abatement will make the short players very nervous. So the pop in prices today is the result of short-covering, the reaffirmation of Chairman Bernanke’s commitment to continued quantitative easing, a continued weaker dollar and higher oil.

Gold’s next important test if all this holds together will be $1360.00 and a move above that level will end the downward channel we have seen since the last quarter of 2012. Still smart traders always expect volatility but for now the technical momentum is in gold’s corner short term.

The surprising background news today included a decline in existing home sales (1.2%). Some commentators claim this number will support continued quantitative easing but the smarter money sees lack of housing supply as the real problem. Time will tell but if other economic metrics miss the mark it will support continued quantitative easing surly for the rest of this year. The most popular gold bullion item sold at CNI today according to our computers was the US Gold Eagle.

Silver followed gold carefully higher by $1.04 and closing at $20.49 the most popular silver bullion product today was the US Silver Eagle (1 oz) both by the 20 coin tubes and the Monster Box. Questions about our silver bullion price guarantee or specific premiums and so forth? See Silver Bullion Grad School

Platinum was up $17.00 at $1446.00 and we actually saw some sellers at this morning’s higher levels but the most popular platinum bullion product today was the Australian Platypus which sells for substantially less than the US Platinum Eagle.

This from Peter Hug (Kitco) is critical for physical gold holders: “It should be a fun day in the blogs as Ben Bernanke does not understand the concept of owning gold – it’s generally a good barometer of confidence in a nations leadership. Bernanke is right that confidence has improved, which has been one of the catalysts for lower prices. Bernanke indicated that gold does poorly in inflationary cycles. Again, I agree, but gold does poorly in the inflationary cycle only when the Fed creates higher real rates to fight the issue. In 1979 gold performed extremely well as the inflationary cycle began and only weakened after the Fed moved rates into the high teens. Gold is a buy into the cycle, not after the cycle matures. Bernanke, a privileged American, should speak with the South Vietnamese when in 1973 they fled (those that could) with gold taels to begin a new life. Domestic currency was worth nothing and wealth transfer, in this case, was only possible through the possession of an internationally recognized medium of value: gold. I suspect Bernanke has never been worried either financially or socially, of course he doesn’t understand the concept of gold.”

I was actually in this same building when Vietnamese brought in gold taels which were smuggled out of Vietnam. And we still see them on occasion today: they are wrapped in brown paper with various markings and when opened present three separate pieces of pure gold sheets all of which add up to exactly 1.2 ounces. The craftsman over there made these perfectly and wrought by hand to a standard which is still accepted though out the world. And Hug makes an underlying point about gold bullion which should never be forgotten: gold bullion is real money under any circumstance and so will not be readily understood if you only see paper money as a medium of exchange. Inflation or not, good times or not, rising prices or not, it always makes sense to have a little gold bullion to fall back on when things go wonky…and while I can’t guarantee the price of gold will always rise…I can guarantee governments of the world will go wonky.

So what happened to the walk-in and phone trade in the face of higher prices? Actually there was a kind of delayed reaction as the public watched gold bust through overhead resistance at $1300.00 and waited for the market to retreat. The minute they decided there was not going to be any significant sell off today the phones began ringing.

Action is still subdued considering the size of the move but this shows how guarded the public have become with all the negative news about gold. Let the short market continue to unwind and we might just see a completely new psychology for both gold and silver. Thanks for reading and enjoy your evening. These markets are volatile and involve risk: Please Read Before Investing

Written by California Numismatic Investments (www.golddealer.com).